Question: 4 1 3 2 5 , 5 4 9 m b Srevery tetei Cumbint Test - Tax Knowledge Assessment Test - Tax Associste ( 2

Srevery tetei Cumbint

Test Tax Knowledge Assessment Test Tax Associste n

Time remering

:

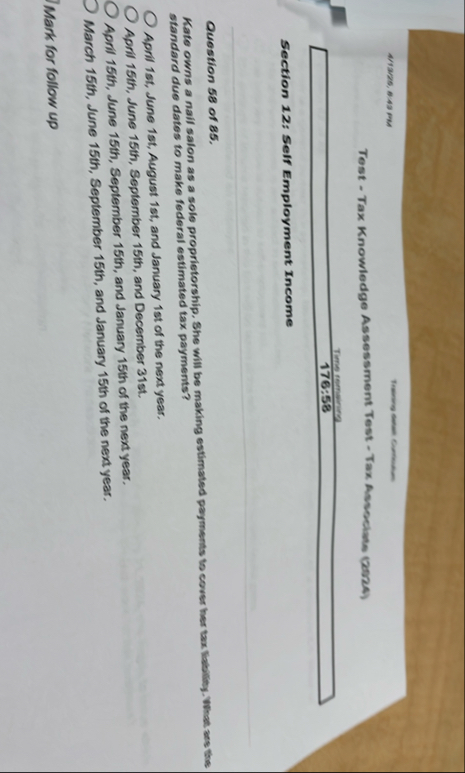

Section : Self Employment Income

Question of

Kate owns a naif salon as a sole proprietorship. She will be making estimated payments to cover her tax liability. What aes the standard due dates to make federal estimated tax payments?

April st June st August st and January st of the next year.

April th June th September th and December st

April th June th September th and January th of the next year.

March th June th September th and January th of the next year.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock