Question: 4 / 1 3 / 2 5 , 7 : 2 6 PM Training detail: Curricilum Chance won $ 1 , 0 0 0 at

: PM

Training detail: Curricilum

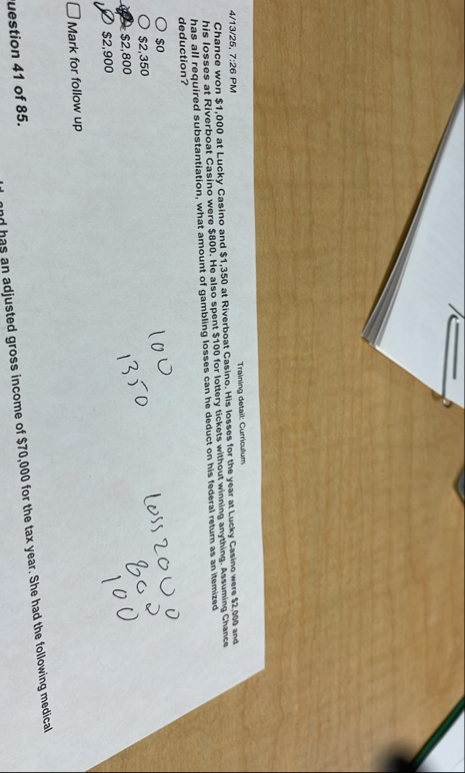

Chance won $ at Lucky Casino and $ at Riverboat Casino. His losses for the year at Lucky Casino were $ and his losses at Riverboat Casino were $ He also spent $ for lottery tickets without winning anything. Assuming Chance has all required substantiation, what amount of gambling losses can he deduct on his federal return as an itemized deduction?

$

$

$

$

Mark for follow up

uestion of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock