Question: 4 / 1 3 / 2 5 , B: 4 2 PM Traporey detek Cumrathe Mark for follow up Question 4 4 of 8 5

B: PM

Traporey detek Cumrathe

Mark for follow up

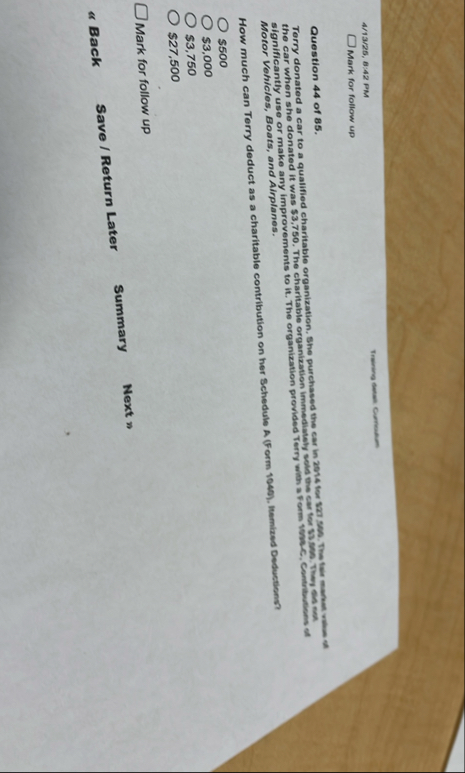

Question of significantly use or make any improvements to it The organization provided Terry with a F orm vovel, Contribubins af Motor Vehicles, Boats, and Airplanes.

How much can Terry deduct as a charitable contribution on her Schedule A Form Itemized Deductions?

$

$

$

Mark for follow up

a

Back Save Return Later

Summary Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock