Question: 4 / 1 4 / 2 5 , 2 : 8 3 PM Treiring setel: Ourredin Test - Gig Income: Airbnb to Uber ( 2

: PM

Treiring setel: Ourredin

Test Gig Income: Airbnb to Uber Test

SEDue Dillgence

Question of

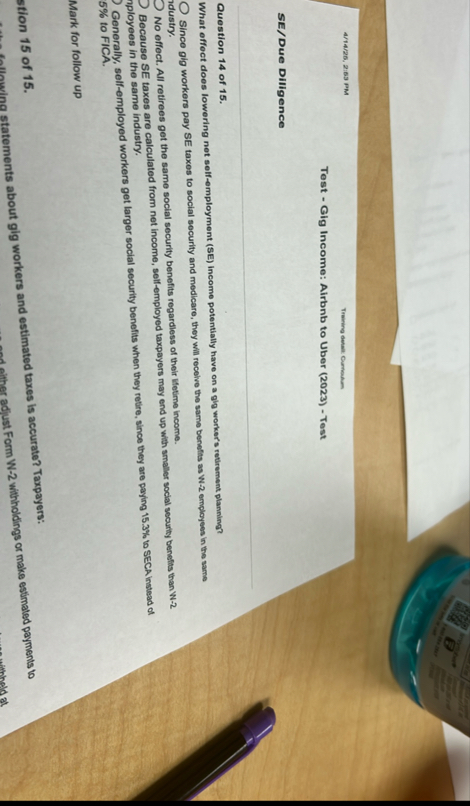

What effect does lowering net selfemployment SE income potentially have on a gla workers retirement planning?

Since gig workers pay SE taxes to social security and medicare, they will recelve the same benefits as W employees in the same adustry.

No effect. All retirees get the same social security benefits regardiess of their lifetime income.

Because SE taxes are calculated from net income, selfemployed taxpayers may end up with smaller social securtiy benelits than W nployees in the same industry.

Generally, selfemployed workers get larger social security benefits when they retire, since they are paying to SECA instead of to FICA.

Mark for follow up

stion of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock