Question: 4 1. Compute and interpret financial ratios that managers use to assess liquidity. 2. Compute and interpret financial ratios that managers use for asset management

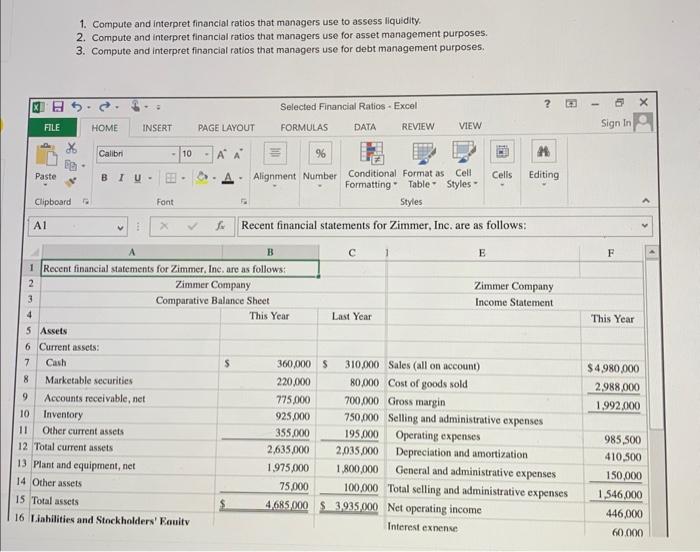

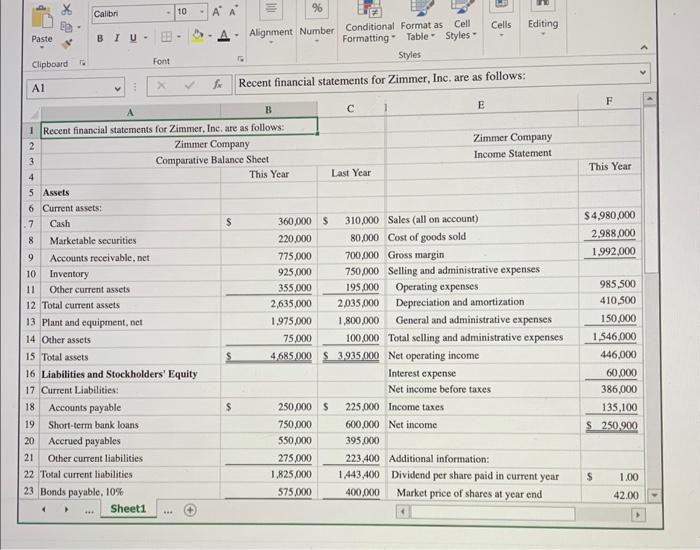

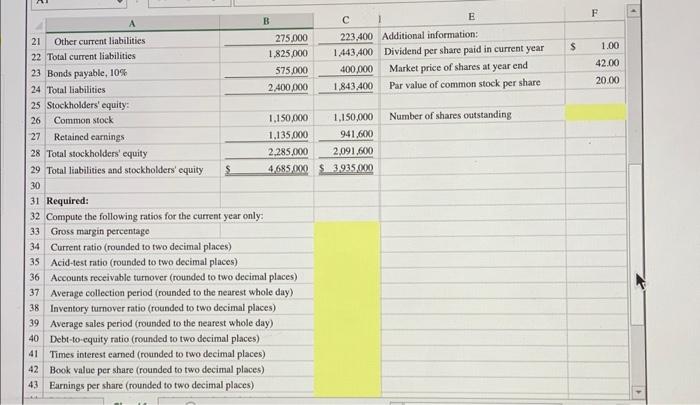

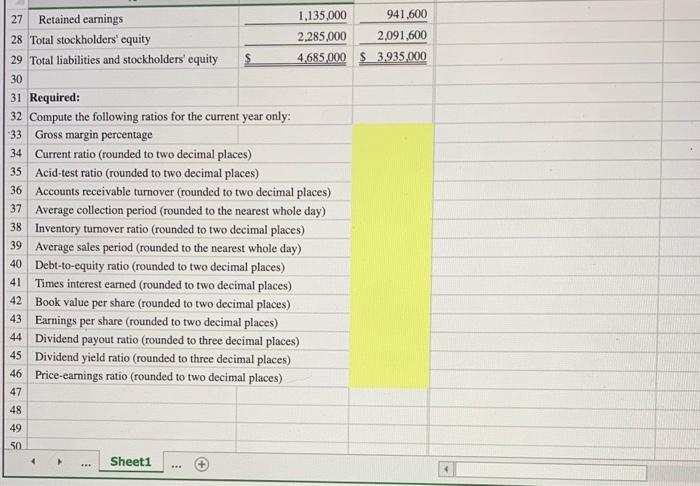

1. Compute and interpret financial ratios that managers use to assess liquidity. 2. Compute and interpret financial ratios that managers use for asset management purposes. 3. Compute and interpret financial ratios that managers use for debt management purposes. \begin{tabular}{|l|l|llr|r} \hline 27 & Retained earnings & 1,135,000 & & 941,600 \\ \cline { 2 - 3 } \cline { 5 - 6 } 28 & Total stockholders' equity & 2,285,000 & & 2,091,600 \\ \hline 29 & Total liabilities and stockholders' equity & $ & 4,685,000 & $3,935,000 \\ \hline \hline \end{tabular} Required: Compute the following ratios for the current year only: Gross margin percentage Current ratio (rounded to two decimal places) Acid-test ratio (rounded to two decimal places) Accounts receivable turnover (rounded to two decimal places) Average collection period (rounded to the nearest whole day) Inventory turnover ratio (rounded to two decimal places) Average sales period (rounded to the nearest whole day) Debt-to-equity ratio (rounded to two decimal places) Times interest earned (rounded to two decimal places) Book value per share (rounded to two decimal places) Earnings per share (rounded to two decimal places) Dividend payout ratio (rounded to three decimal places) Dividend yield ratio (rounded to three decimal places) Price-earnings ratio (rounded to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts