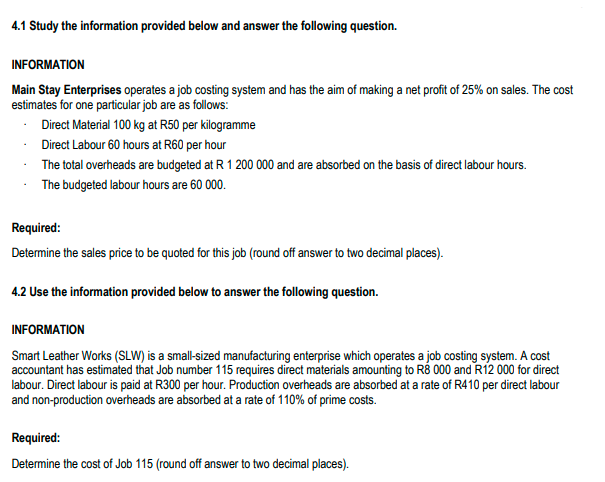

Question: 4 . 1 Study the information provided below and answer the following question. INFORMATION Main Stay Enterprises operates a job costing system and has the

Study the information provided below and answer the following question.

INFORMATION

Main Stay Enterprises operates a job costing system and has the aim of making a net profit of on sales. The cost

estimates for one particular job are as follows:

Direct Material at R per kilogramme

Direct Labour hours at per hour

The total overheads are budgeted at R and are absorbed on the basis of direct labour hours.

The budgeted labour hours are

Required:

Determine the sales price to be quoted for this job round off answer to two decimal places

Use the information provided below to answer the following question.

INFORMATION

Smart Leather Works SLW is a smallsized manufacturing enterprise which operates a job costing system. A cost

accountant has estimated that Job number requires direct materials amounting to R and R for direct

labour. Direct labour is paid at R per hour. Production overheads are absorbed at a rate of R per direct labour

and nonproduction overheads are absorbed at a rate of of prime costs.

Required:

Determine the cost of Job round off answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock