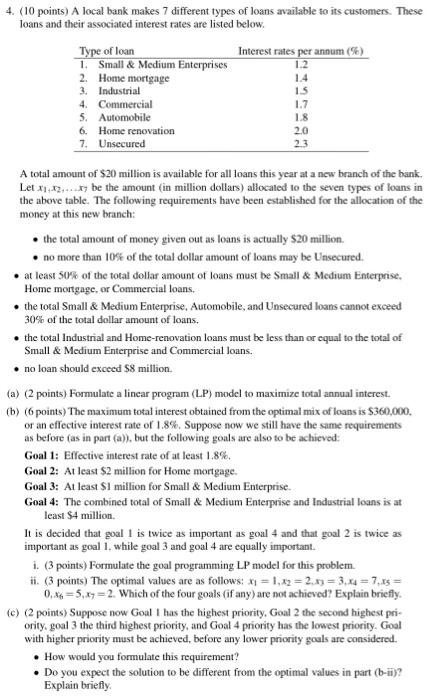

Question: 4. (10 points) A local bank makes 7 different types of loans available to its customers. These loans and their associated interest rates are listed

4. (10 points) A local bank makes 7 different types of loans available to its customers. These loans and their associated interest rates are listed below. A total amount of $20 million is available for all loans this year at a new branch of the bank. Let x1,x2,x7 be the amount (in million dollars) allocaled to the seven types of loans in the above table. The following requirements have been established for the allocation of the money at this new branch: - the total amount of money given out as loans is actually $20 million. - no more than 105 of the total dollar amount of loans may be Unsecured. - at least 50% of the total dollar amount of loans must be Small \& Medium Enterprise. Home mortgage, or Commercial loans. - the total Small \& Medium Enterprise, Automobile, and Unsecured loans cannot exceed 30% of the total dollar amount of loans. - the total lndustrial and Home-renovation loans must be less than or equal to the total of Small \& Medium Enterprise and Commercial Joans. - no loan should excecd $8 million. (a) (2 points) Formulate a linear program (LP) model to maximize total annual interest. (b) (6 points) The maximum total interest obtained from the optimal mix of loans is $360,000. or an effective interest rate of 1.8%. Suppose now we still have the same requirements as before (as in part (a)), but the following goals are also to be achieved: Goal 1: Effective interest rate of at least 1.8%. Goal 2: At least $2 milion for Home mortgage. Goal 3: At least \$1 million for Small \& Medium Enterprise. Goal 4: The combined total of Small \& Medium Enterpoise and Industrial loans is at least $4 million. It is decided that goal 1 is twice as important as goal 4 and that goal 2 is twice as important as goal 1. while goal 3 and goal 4 are equally important. i. ( 3 points) Formulate the goal programming LP model for this problem. ii. (3 points) The optimal values are as follows: x1=1,x2=2,x3=3,x4=7,x5= 0,x6=5,x7=2. Which of the four goals (if any) are not achicved? Explain bricfly. (c) (2 points) Suppose now Goal I has the highest priority. Goal 2 the second highest priority. goal 3 the third highest priority, and Goal 4 priority has the lowest priority. Goal with higher priority must be achieved, before any lower priority goals are considered. - How would you formulate this requirement? - Do you expect the solution to be different from the optimal values in part (b-ii)? Explain briefly. 4. (10 points) A local bank makes 7 different types of loans available to its customers. These loans and their associated interest rates are listed below. A total amount of $20 million is available for all loans this year at a new branch of the bank. Let x1,x2,x7 be the amount (in million dollars) allocaled to the seven types of loans in the above table. The following requirements have been established for the allocation of the money at this new branch: - the total amount of money given out as loans is actually $20 million. - no more than 105 of the total dollar amount of loans may be Unsecured. - at least 50% of the total dollar amount of loans must be Small \& Medium Enterprise. Home mortgage, or Commercial loans. - the total Small \& Medium Enterprise, Automobile, and Unsecured loans cannot exceed 30% of the total dollar amount of loans. - the total lndustrial and Home-renovation loans must be less than or equal to the total of Small \& Medium Enterprise and Commercial Joans. - no loan should excecd $8 million. (a) (2 points) Formulate a linear program (LP) model to maximize total annual interest. (b) (6 points) The maximum total interest obtained from the optimal mix of loans is $360,000. or an effective interest rate of 1.8%. Suppose now we still have the same requirements as before (as in part (a)), but the following goals are also to be achieved: Goal 1: Effective interest rate of at least 1.8%. Goal 2: At least $2 milion for Home mortgage. Goal 3: At least \$1 million for Small \& Medium Enterprise. Goal 4: The combined total of Small \& Medium Enterpoise and Industrial loans is at least $4 million. It is decided that goal 1 is twice as important as goal 4 and that goal 2 is twice as important as goal 1. while goal 3 and goal 4 are equally important. i. ( 3 points) Formulate the goal programming LP model for this problem. ii. (3 points) The optimal values are as follows: x1=1,x2=2,x3=3,x4=7,x5= 0,x6=5,x7=2. Which of the four goals (if any) are not achicved? Explain bricfly. (c) (2 points) Suppose now Goal I has the highest priority. Goal 2 the second highest priority. goal 3 the third highest priority, and Goal 4 priority has the lowest priority. Goal with higher priority must be achieved, before any lower priority goals are considered. - How would you formulate this requirement? - Do you expect the solution to be different from the optimal values in part (b-ii)? Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts