Question: 4. (10 points) Problem - unlevered beta and the effect of leverage on beta Movie Inc., an entertainment conglomerate, has a beta of 1.60. Part

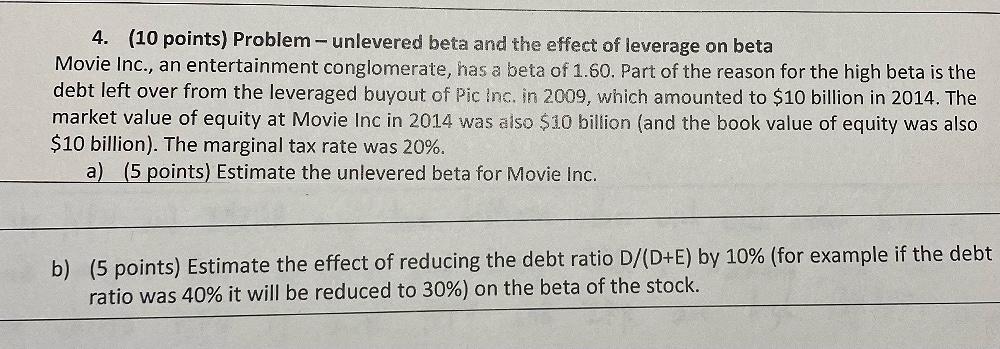

4. (10 points) Problem - unlevered beta and the effect of leverage on beta Movie Inc., an entertainment conglomerate, has a beta of 1.60. Part of the reason for the high beta is the debt left over from the leveraged buyout of Pic Inc. in 2009, which amounted to $10 billion in 2014. The market value of equity at Movie Inc in 2014 was also $10 billion (and the book value of equity was also $10 billion). The marginal tax rate was 20%. a) (5 points) Estimate the unlevered beta for Movie Inc. b) (5 points) Estimate the effect of reducing the debt ratio D/(D+E) by 10% (for example if the debt ratio was 40% it will be reduced to 30%) on the beta of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts