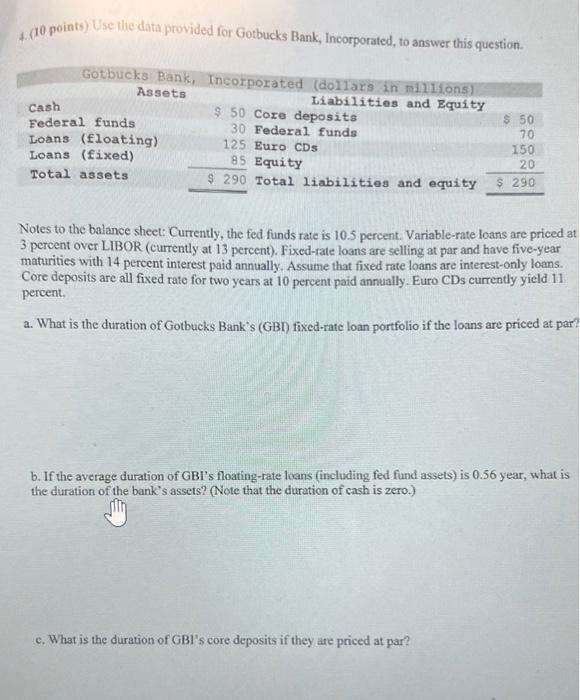

Question: 4. (10 points) Use the data provided for Gotbucks Bank, Incorporated, to answer this question. Notes to the balance sheet: Currently, the fed funds rate

4. (10 points) Use the data provided for Gotbucks Bank, Incorporated, to answer this question. Notes to the balance sheet: Currently, the fed funds rate is 10.5 percent. Variable-rate loans are priced at 3 percent over LIBOR (currently at 13 percent). Fixed-rate loans are selling at par and have five-year maturities with 14 percent interest paid annually. Assume that fixed rate loans are interest-only loans. Core deposits are all fixed rate for two years at 10 percent paid annually. Euro CDs currently yield 11 percent. a. What is the duration of Gotbucks Bank's (GBI) fixed-rate loan portfolio if the loans are priced at par b. If the average duration of GBI's floating-rate loans (including fed fund assets) is 0.56 year, what is the duration of the bank's assets? (Note that the duration of cash is zero.) c. What is the duration of GBI's core deposits if they are priced at par? 4. (10 points) Use the data provided for Gotbucks Bank, Incorporated, to answer this question. Notes to the balance sheet: Currently, the fed funds rate is 10.5 percent. Variable-rate loans are priced at 3 percent over LIBOR (currently at 13 percent). Fixed-rate loans are selling at par and have five-year maturities with 14 percent interest paid annually. Assume that fixed rate loans are interest-only loans. Core deposits are all fixed rate for two years at 10 percent paid annually. Euro CDs currently yield 11 percent. a. What is the duration of Gotbucks Bank's (GBI) fixed-rate loan portfolio if the loans are priced at par b. If the average duration of GBI's floating-rate loans (including fed fund assets) is 0.56 year, what is the duration of the bank's assets? (Note that the duration of cash is zero.) c. What is the duration of GBI's core deposits if they are priced at par

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts