Question: 4) 13 Points. Simple Deposit Creation Problem. hi this exercise, assume that banks hold no excess reserves and that all loan proceeds are deposited into

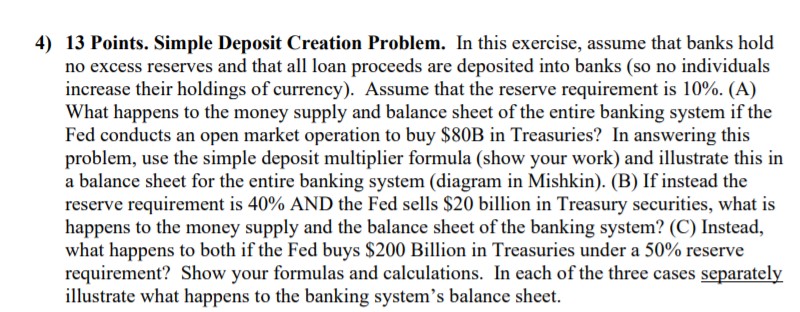

4) 13 Points. Simple Deposit Creation Problem. hi this exercise, assume that banks hold no excess reserves and that all loan proceeds are deposited into banks (so no individuals increase their holdings of currency). Assume that the reserve requirement is 10%. (A) What happens to the money supply and balance sheet of the entire banking system if the Fed conducts an open market operation to buy $803 in Treasuries? In answering this problem, use the simple deposit multiplier formula (show your work) and illustrate this in a balance sheet for the entire banking system (diagram in Mishkin). (B) If instead the reserve requirement is 40% AND the Fed sells $20 billion in Treasury securities, what is happens to the money supply and the balance sheet of the banking system? (C) Instead, what happens to both if the Fed buys $200 Billion in Treasuries under a 50% reserve requirement? Show your formulas and calculations. In each of the three cases separate1y_ illustrate what happens to the banking system's balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts