Question: 4. (18 points) (a) Consider the following quote from a WSJ article itled Long-Duration Bond Funds Thrive Amid Market Carnage. A group of funds that

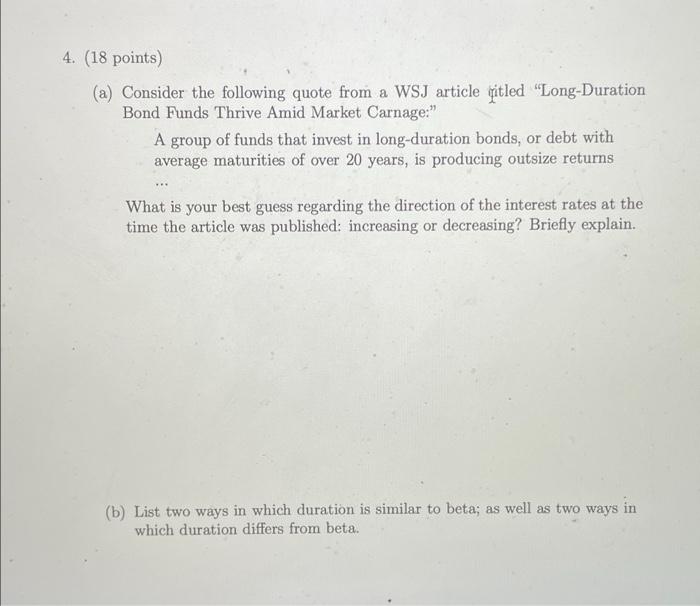

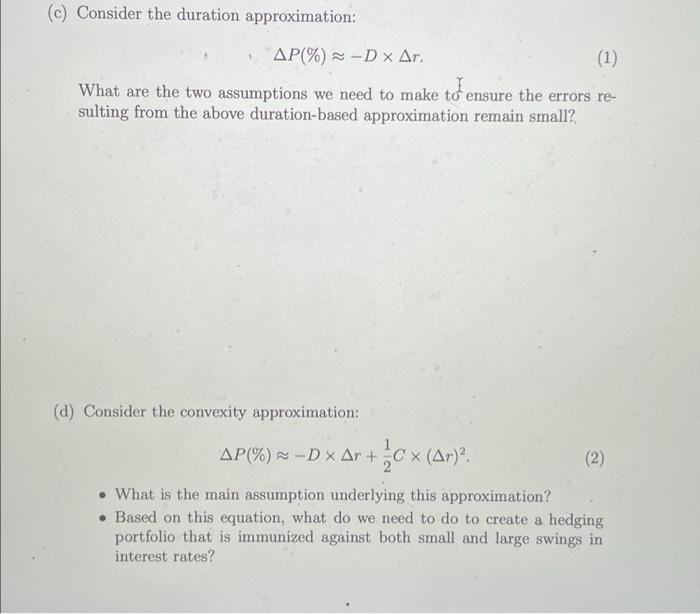

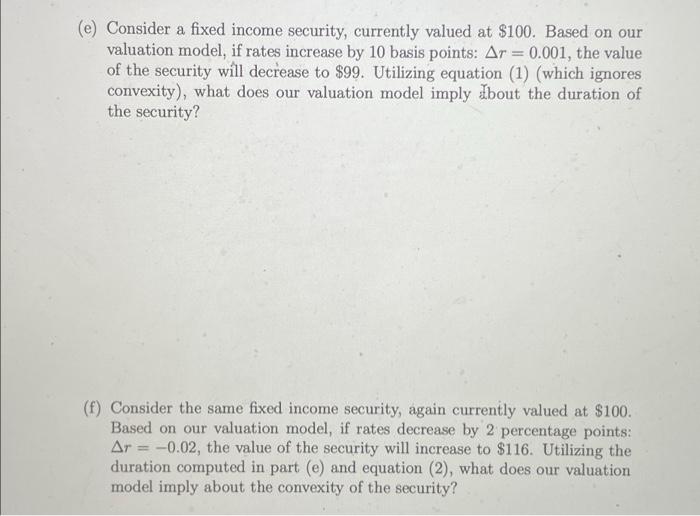

4. (18 points) (a) Consider the following quote from a WSJ article itled "Long-Duration Bond Funds Thrive Amid Market Carnage." A group of funds that invest in long-duration bonds, or debt with average maturities of over 20 years, is producing outsize returns What is your best guess regarding the direction of the interest rates at the time the article was published: increasing or decreasing? Briefly explain. (b) List two ways in which duration is similar to beta; as well as two ways in which duration differs from beta. (c) Consider the duration approximation: (%) 3-Dx r. (1) What are the two assumptions we need to make to ensure the errors re- sulting from the above duration-based approximation remain small? (d) Consider the convexity approximation: AP(%) ~-D x Ar+c x (Ar)? (2) ) 2 What is the main assumption underlying this approximation? Based on this equation, what do we need to do to create a hedging portfolio that is immunized against both small and large swings in interest rates? a (e) Consider a fixed income security, currently valued at $100. Based on our valuation model, if rates increase by 10 basis points: Ar = 0.001, the value of the security will decrease to $99. Utilizing equation (1) (which ignores convexity), what does our valuation model imply about the duration of the security? (f) Consider the same fixed income security, again currently valued at $100. Based on our valuation model, if rates decrease by 2 percentage points: Ar = -0.02, the value of the security will increase to $116. Utilizing the duration computed in part (e) and equation (2), what does our valuation model imply about the convexity of the security? 4. (18 points) (a) Consider the following quote from a WSJ article itled "Long-Duration Bond Funds Thrive Amid Market Carnage." A group of funds that invest in long-duration bonds, or debt with average maturities of over 20 years, is producing outsize returns What is your best guess regarding the direction of the interest rates at the time the article was published: increasing or decreasing? Briefly explain. (b) List two ways in which duration is similar to beta; as well as two ways in which duration differs from beta. (c) Consider the duration approximation: (%) 3-Dx r. (1) What are the two assumptions we need to make to ensure the errors re- sulting from the above duration-based approximation remain small? (d) Consider the convexity approximation: AP(%) ~-D x Ar+c x (Ar)? (2) ) 2 What is the main assumption underlying this approximation? Based on this equation, what do we need to do to create a hedging portfolio that is immunized against both small and large swings in interest rates? a (e) Consider a fixed income security, currently valued at $100. Based on our valuation model, if rates increase by 10 basis points: Ar = 0.001, the value of the security will decrease to $99. Utilizing equation (1) (which ignores convexity), what does our valuation model imply about the duration of the security? (f) Consider the same fixed income security, again currently valued at $100. Based on our valuation model, if rates decrease by 2 percentage points: Ar = -0.02, the value of the security will increase to $116. Utilizing the duration computed in part (e) and equation (2), what does our valuation model imply about the convexity of the security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts