Question: 4. 19 (a) What is foreign exchange risk? (b) What does it mean for an FI to be net long in foreign assets? What does

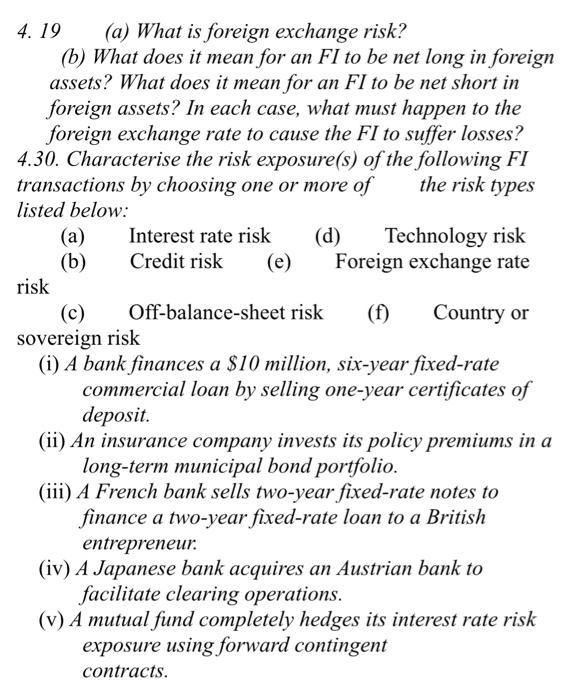

4. 19 (a) What is foreign exchange risk? (b) What does it mean for an FI to be net long in foreign assets? What does it mean for an FI to be net short in foreign assets? In each case, what must happen to the foreign exchange rate to cause the FI to suffer losses? 4.30. Characterise the risk exposure(s) of the following FI transactions by choosing one or more of the risk types listed below: (a) Interest rate risk (d) Technology risk (b) Credit risk (e) Foreign exchange rate risk (c) Off-balance-sheet risk Country or sovereign risk (i) A bank finances a $10 million, six-year fixed-rate commercial loan by selling one-year certificates of deposit. (ii) An insurance company invests its policy premiums in a long-term municipal bond portfolio. (iii) A French bank sells two-year fixed-rate notes to finance a two-year fixed-rate loan to a British entrepreneur. (iv) A Japanese bank acquires an Austrian bank to facilitate clearing operations. (v) A mutual fund completely hedges its interest rate risk exposure using forward contingent contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts