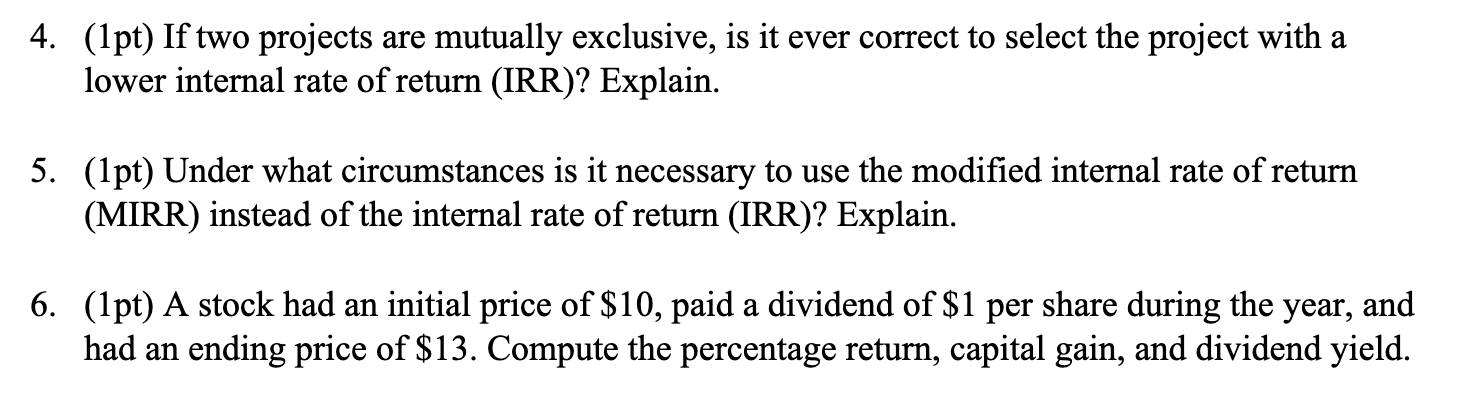

Question: 4. (1pt) If two projects are mutually exclusive, is it ever correct to select the project with a lower internal rate of return (IRR)? Explain.

4. (1pt) If two projects are mutually exclusive, is it ever correct to select the project with a lower internal rate of return (IRR)? Explain. 5. (1pt) Under what circumstances is it necessary to use the modified internal rate of return (MIRR) instead of the internal rate of return (IRR)? Explain. 6. (1pt) A stock had an initial price of $10, paid a dividend of $1 per share during the year, and had an ending price of $13. Compute the percentage return, capital gain, and dividend yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts