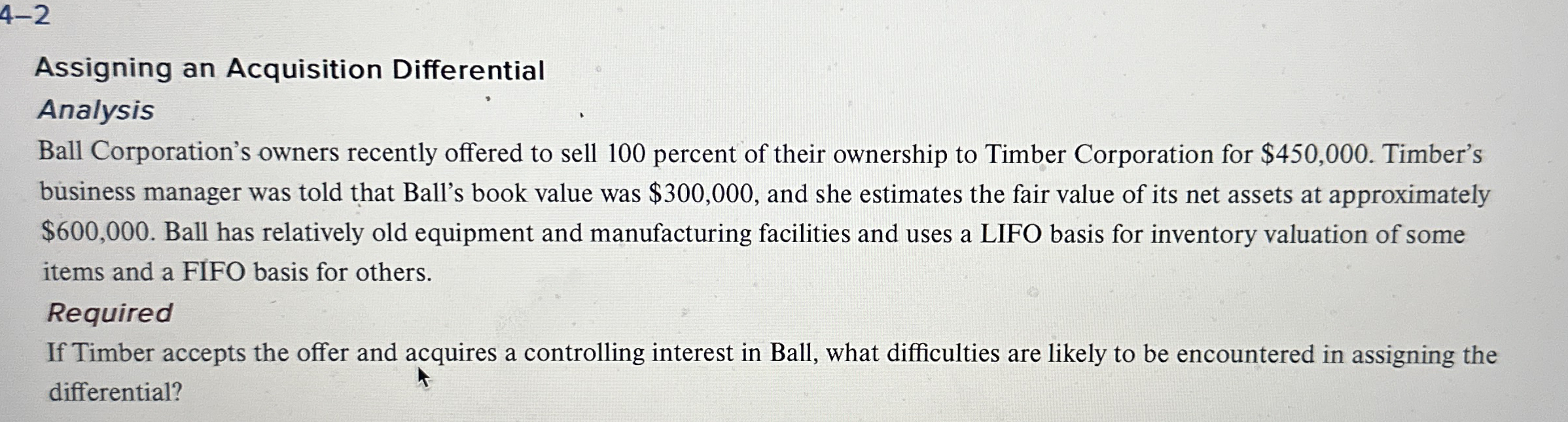

Question: 4 - 2 Assigning an Acquisition Differential Analysis Ball Corporation's owners recently offered to sell 1 0 0 percent of their ownership to Timber Corporation

Assigning an Acquisition Differential

Analysis

Ball Corporation's owners recently offered to sell percent of their ownership to Timber Corporation for $ Timber's

business manager was told that Ball's book value was $ and she estimates the fair value of its net assets at approximately

$ Ball has relatively old equipment and manufacturing facilities and uses a LIFO basis for inventory valuation of some

items and a FIFO basis for others.

Required

If Timber accepts the offer and acquires a controlling interest in Ball, what difficulties are likely to be encountered in assigning the

differential?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock