Question: 4. (20 points) A European call option and put option on a stock both have a strike price of $95 and an expiration date in

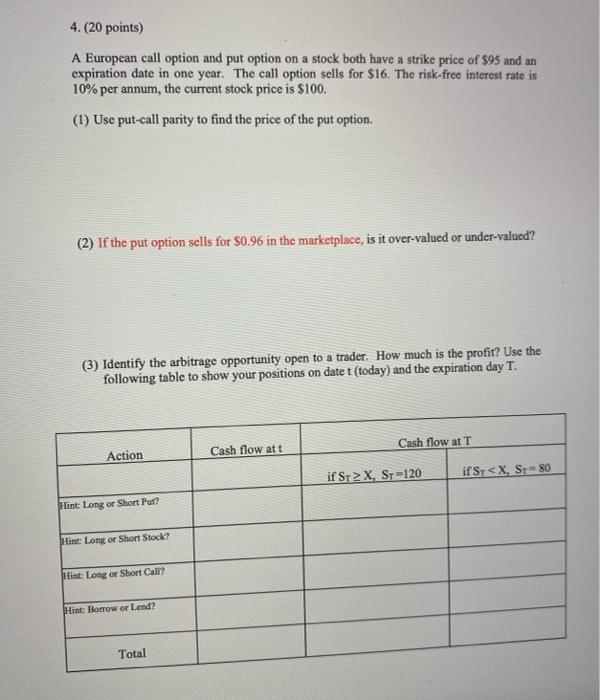

4. (20 points) A European call option and put option on a stock both have a strike price of $95 and an expiration date in one year. The call option sells for $16. The risk-free interest rate is 10% per annum, the current stock price is $100. (1) Use put-call parity to find the price of the put option. (2) If the put option sells for $0.96 in the marketplace, is it over-valued or under-valued? (3) Identify the arbitrage opportunity open to a trader. How much is the profit? Use the following table to show your positions on date t (today) and the expiration day T. Cash flow at T Action Cash flow att if S2 X, ST-120 ifs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts