Question: 4. (20 points) We have the following three models for the weekly rate of return (Y, ) in the US/Euro currency exchange market from January

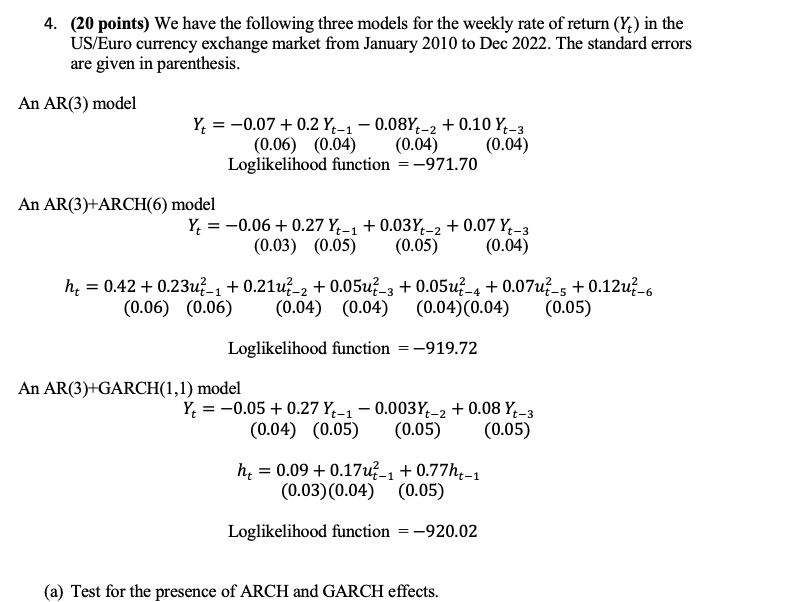

4. (20 points) We have the following three models for the weekly rate of return (Y, ) in the US/Euro currency exchange market from January 2010 to Dec 2022. The standard errors are given in parenthesis. An AR(3) model Y, = -0.07 + 0.2 Yt-1 - 0.08Yt-2 + 0.10 Yt-3 (0.06) (0.04) (0.04) (0.04) Loglikelihood function = -971.70 An AR(3)+ARCH(6) model Y, = -0.06 + 0.27 Yt-1 + 0.03Yt-2 + 0.07 Yt-3 (0.03) (0.05) (0.05) (0.04) h = 0.42 + 0.23uf_1 + 0.21u?_2 + 0.05u7-3 + 0.05uf_4 + 0.07up_s + 0.12up-6 (0.06) (0.06) (0.04) (0.04) (0.04) (0.04) (0.05) Loglikelihood function = -919.72 An AR(3)+GARCH(1,1) model Y = -0.05 + 0.27 Yt_1 - 0.003Y+-2 + 0.08 Yt-3 (0.04) (0.05) (0.05) (0.05) he = 0.09 + 0.17uf_1 + 0.77ht-1 (0.03) (0.04) (0.05) Loglikelihood function = -920.02 (a) Test for the presence of ARCH and GARCH effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts