Question: A special purpose vehicle borrows from a commercial bank based on a floating rate of LIBOR+1.5% with semiannual resets. Given the following LIBOR rate

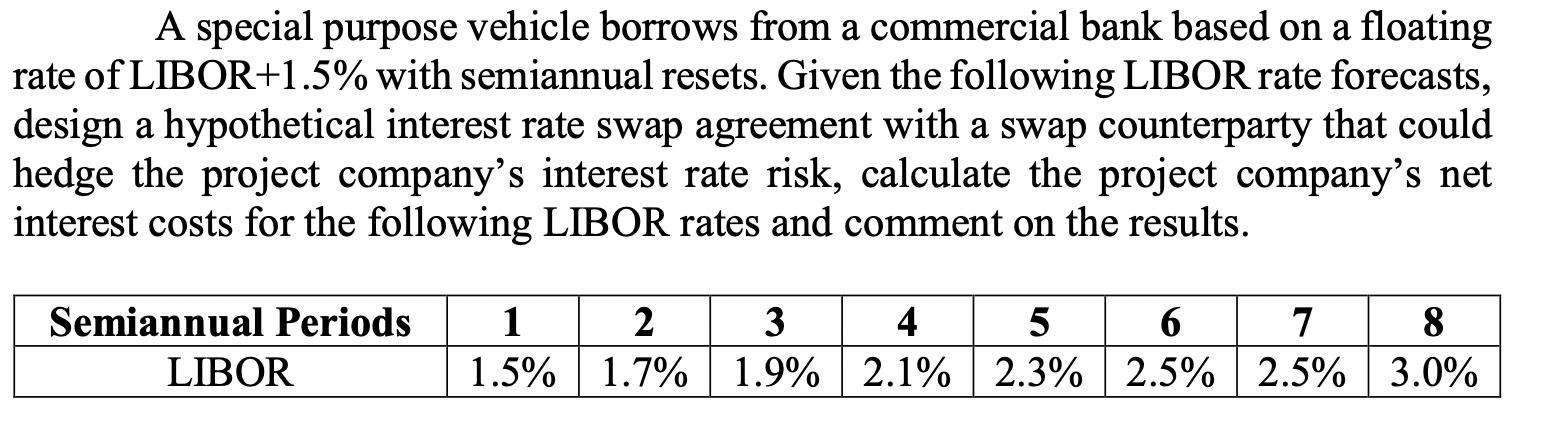

A special purpose vehicle borrows from a commercial bank based on a floating rate of LIBOR+1.5% with semiannual resets. Given the following LIBOR rate forecasts, design a hypothetical interest rate swap agreement with a swap counterparty that could hedge the project company's interest rate risk, calculate the project company's net interest costs for the following LIBOR rates and comment on the results. Semiannual Periods 1 2 1.5% 1.7% LIBOR 3 4 1.9% 2.1% 5 6 7 2.3% 2.5% 2.5% 8 3.0%

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

For this scenario the project company would enter into an interest rat... View full answer

Get step-by-step solutions from verified subject matter experts