Question: 4. (25 pts) Please answer the two questions below. SHOW YOUR WORK FOR ALL PARTS. (a) Calculate the implied forward rate for a one-year security

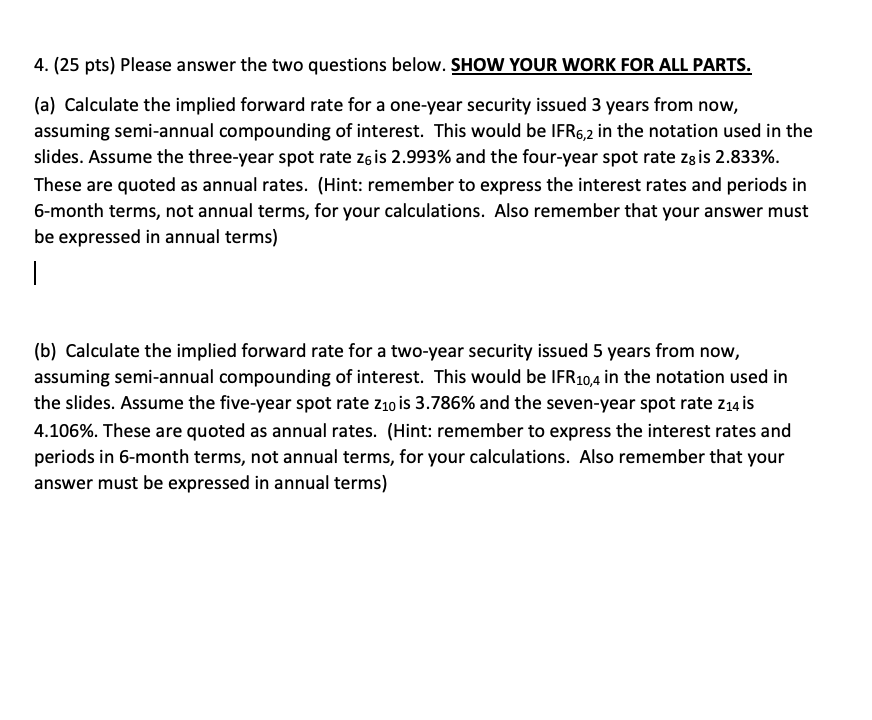

4. (25 pts) Please answer the two questions below. SHOW YOUR WORK FOR ALL PARTS. (a) Calculate the implied forward rate for a one-year security issued 3 years from now, assuming semi-annual compounding of interest. This would be IFR6,2 in the notation used in the slides. Assume the three-year spot rate z6 is 2.993% and the four-year spot rate z8 is 2.833%. These are quoted as annual rates. (Hint: remember to express the interest rates and periods in 6-month terms, not annual terms, for your calculations. Also remember that your answer must be expressed in annual terms) (b) Calculate the implied forward rate for a two-year security issued 5 years from now, assuming semi-annual compounding of interest. This would be IFR10,4 in the notation used in the slides. Assume the five-year spot rate z10 is 3.786% and the seven-year spot rate z14 is 4.106%. These are quoted as annual rates. (Hint: remember to express the interest rates and periods in 6-month terms, not annual terms, for your calculations. Also remember that your answer must be expressed in annual terms)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts