Question: 4 3 n EXHIBITS Year 3 Dererciation and Am - Year 3 . Asset Acquisitions Year 3 . Asset Discositions MACRS Deoreciation Rate T -

EXHIBITS

Year Dererciation and Am

Year Asset Acquisitions

Year Asset Discositions

MACRS Deoreciation Rate T

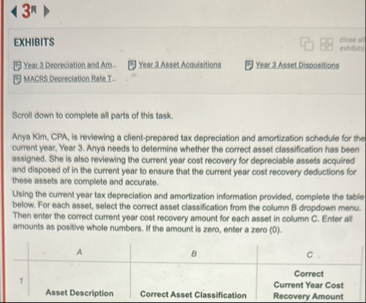

Scroll down to complete all parts of this task.

Aryan KIm, CPA, Is reviewing a clientprepared tax depreciation and amortization schedule for the current year, Year Anya needs to determine whether the correct asset classification has been assigned. She is also reviewing the current year cost recovery for depreciable assets acquired and disposed of in the current year to ensure that the current year cost recovery deductions for these assets are complete and accurate.

Using the current year tax depreciation and amortization information provided, complete the table below. For each asset, select the correct asset classification from the column B dropdown menu. Then enter the correct current year cost recovery amount for each asset in column C Enter all amounts as positive whole numbers. If the amount its zero, enter a zero

tableA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock