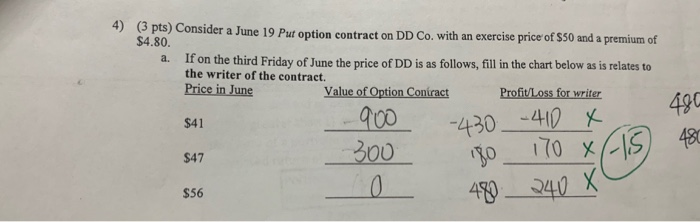

Question: 4) (3 pts) Consider a June 19 Put option contract on DD Co. with an exercise price of $50 and a premium of $4.80. a.

4) (3 pts) Consider a June 19 Put option contract on DD Co. with an exercise price of $50 and a premium of $4.80. a. If on the third Friday of June the price of DD is as follows, fill in the chart below as is relates to the writer of the contract. Price in June Value of Option Contract Profit/Loss for writer $41 -900 -430 -410 x 300 $47 180 170 X CIS 0 480 240 X 480 480 $56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts