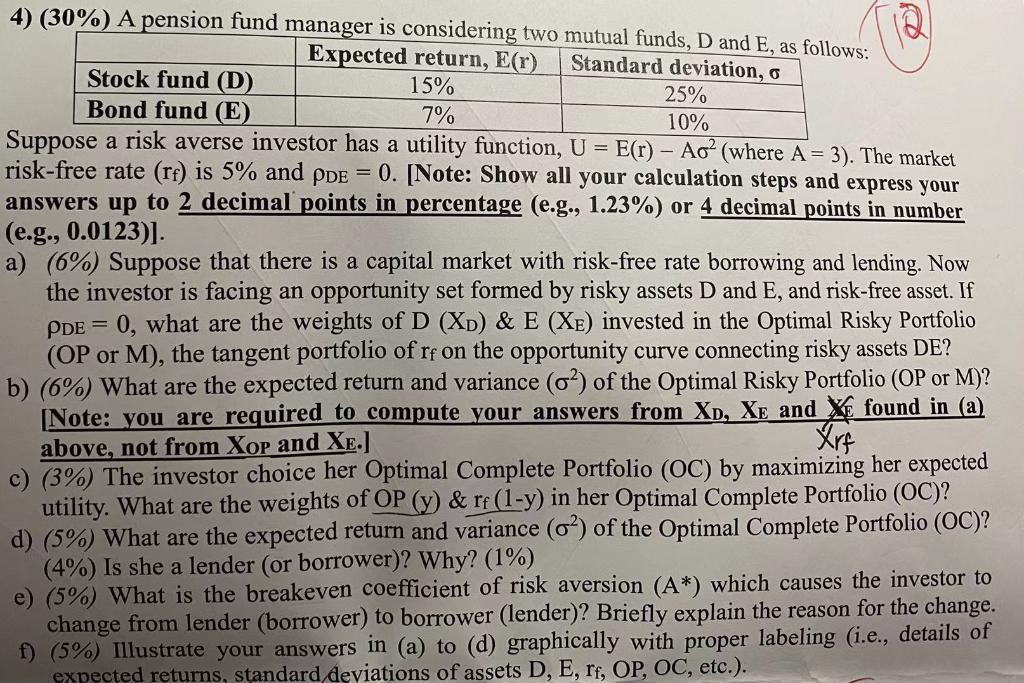

Question: 4) (30%) A pension fund manager is considering two mutual funds, D and E, as follows: Expected return, E(r) Standard deviation, o Stock fund (D)

4) (30%) A pension fund manager is considering two mutual funds, D and E, as follows: Expected return, E(r) Standard deviation, o Stock fund (D) 15% 25% Bond fund (E) 7% 10% Suppose a risk averse investor has a utility function, U = E(r) Ao? (where A = 3). The market risk-free rate (rf) is 5% and PDE = 0. [Note: Show all your calculation steps and express your answers up to 2 decimal points in percentage (e.g., 1.23%) or 4 decimal points in number (e.g., 0.0123)]. a) (6%) Suppose that there is a capital market with risk-free rate borrowing and lending. Now the investor is facing an opportunity set formed by risky assets D and E, and risk-free asset. If PDE = 0, what are the weights of D (XD) & E (XE) invested in the Optimal Risky Portfolio (OP or M), the tangent portfolio of rf on the opportunity curve connecting risky assets DE? b) (6%) What are the expected return and variance (o?) of the Optimal Risky Portfolio (OP or M)? [Note: you are required to compute your answers from XD, XE and XE found in (a) above, not from Xop and XE.) c) (3%) The investor choice her Optimal Complete Portfolio (OC) by maximizing her expected utility. What are the weights of OP (y) & rf (1-y) in her Optimal Complete Portfolio (OC)? d) (5%) What are the expected return and variance (o?) of the Optimal Complete Portfolio (OC)? (4%) Is she a lender (or borrower)? Why? (1%) e) (5%) What is the breakeven coefficient of risk aversion (A*) which causes the investor to change from lender (borrower) to borrower (lender)? Briefly explain the reason for the change. f) (5%) Illustrate your answers in (a) to (d) graphically with proper labeling (i.e., details of expected returns, standard deviations of assets D, E, rf, OP, OC, etc.). 4) (30%) A pension fund manager is considering two mutual funds, D and E, as follows: Expected return, E(r) Standard deviation, o Stock fund (D) 15% 25% Bond fund (E) 7% 10% Suppose a risk averse investor has a utility function, U = E(r) Ao? (where A = 3). The market risk-free rate (rf) is 5% and PDE = 0. [Note: Show all your calculation steps and express your answers up to 2 decimal points in percentage (e.g., 1.23%) or 4 decimal points in number (e.g., 0.0123)]. a) (6%) Suppose that there is a capital market with risk-free rate borrowing and lending. Now the investor is facing an opportunity set formed by risky assets D and E, and risk-free asset. If PDE = 0, what are the weights of D (XD) & E (XE) invested in the Optimal Risky Portfolio (OP or M), the tangent portfolio of rf on the opportunity curve connecting risky assets DE? b) (6%) What are the expected return and variance (o?) of the Optimal Risky Portfolio (OP or M)? [Note: you are required to compute your answers from XD, XE and XE found in (a) above, not from Xop and XE.) c) (3%) The investor choice her Optimal Complete Portfolio (OC) by maximizing her expected utility. What are the weights of OP (y) & rf (1-y) in her Optimal Complete Portfolio (OC)? d) (5%) What are the expected return and variance (o?) of the Optimal Complete Portfolio (OC)? (4%) Is she a lender (or borrower)? Why? (1%) e) (5%) What is the breakeven coefficient of risk aversion (A*) which causes the investor to change from lender (borrower) to borrower (lender)? Briefly explain the reason for the change. f) (5%) Illustrate your answers in (a) to (d) graphically with proper labeling (i.e., details of expected returns, standard deviations of assets D, E, rf, OP, OC, etc.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts