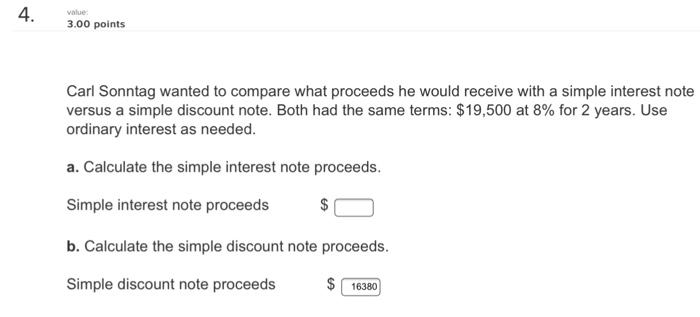

Question: 4 30points value Carl Sonntag wanted to compare what proceeds he would receive with a simple interest note versus a simple discount note. Both had

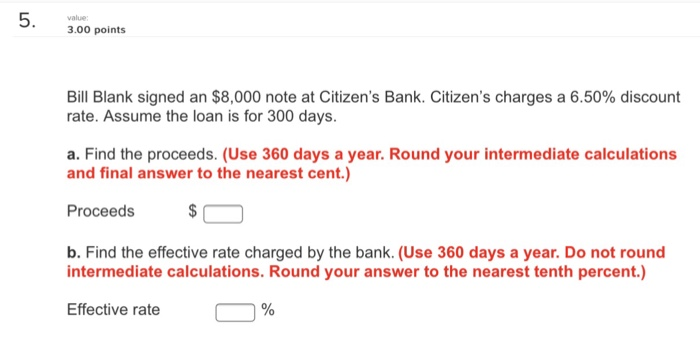

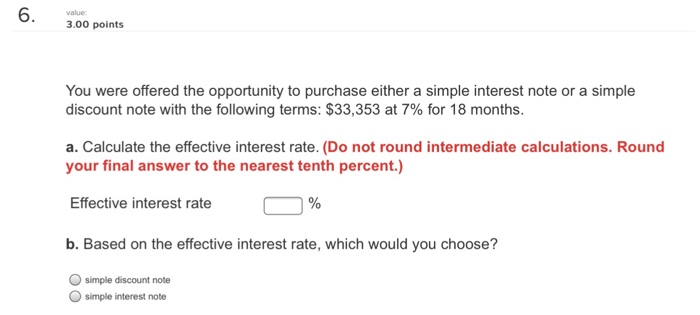

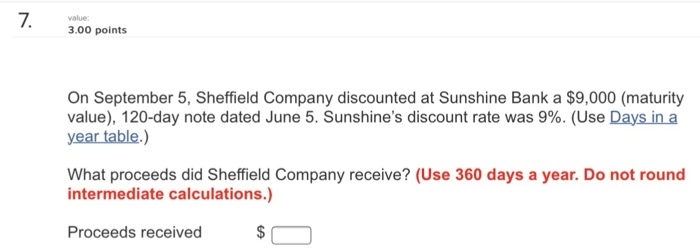

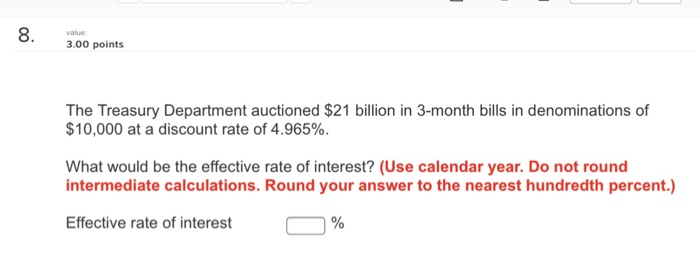

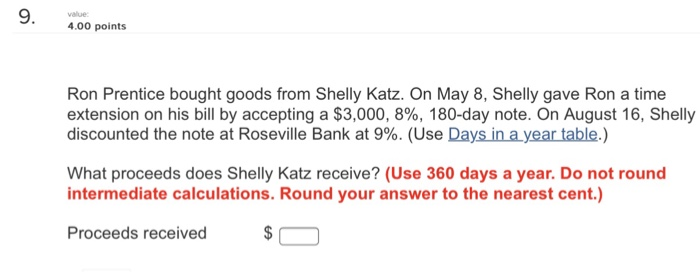

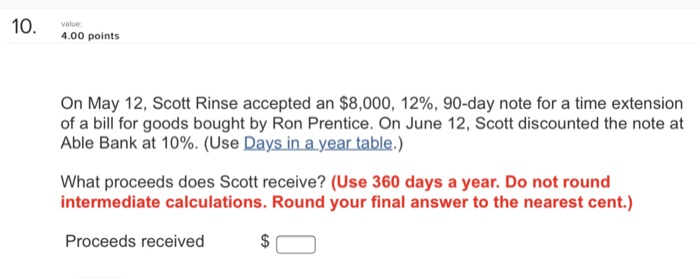

4 30points value Carl Sonntag wanted to compare what proceeds he would receive with a simple interest note versus a simple discount note. Both had the same terms: $19,500 at 8% for 2 years. Use ordinary interest as needed. a. Calculate the simple interest note proceeds. Simple interest note proceeds b. Calculate the simple discount note proceeds Simple discount note proceeds 16380 value .00 points Bill Blank signed an $8,000 note at Citizen's Bank, Citizen's charges a 6.50% discount rate. Assume the loan is for 300 days. a. Find the proceeds. (Use 360 days a year. Round your intermediate calculations and final answer to the nearest cent.) Proceeds b. Find the effective rate charged by the bank. (Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest tenth percent.) Effective rate 0 % 6 value 3.00 points You were offered the opportunity to purchase either a simple interest note or a simple discount note with the following terms: $33,353 at 7% for 18 months. a. Calculate the effective interest rate. (Do not round intermediate calculations. Round your final answer to the nearest tenth percent.) Effective interest rate 0 % b. Based on the effective interest rate, which would you choose? simple discount note simple interest note value: 3.00 points On September 5, Sheffield Company discounted at Sunshine Bank a $9,000 (maturity value), 120-day note dated June 5, Sunshine's discount rate was 9%. (Use Days in a year table.) What proceeds did Sheffield Company receive? (Use 360 days a year. Do not round intermediate calculations.) Proceeds received value 3.00 points The Treasury Department auctioned $21 billion in 3-month bills in denominations of $10,000 at a discount rate of 4.965%. What would be the effective rate of interest? (Use calendar year. Do not round intermediate calculations. Round your answer to the nearest hundredth percent.) Effective rate of interest % value: 4.00 points Ron Prentice bought goods from Shelly Katz. On May 8, Shelly gave Ron a time extension on his bill by accepting a $3,000, 8%, 180-day note. On August 16, Shelly discounted the note at Roseville Bank at 9%. (Use Days in a yeartable.) What proceeds does Shelly Katz receive? (Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Proceeds received 10, vale 4.00 points On May 12, Scott Rinse accepted an $8,000, 12%, 90-day note for a time extension of a bill for goods bought by Ron Prentice. On June 12, Scott discounted the note at Able Bank at 10%. (Use Days in a year table.) What proceeds does Scott receive? (Use 360 days a year. Do not round intermediate calculations. Round your final answer to the nearest cent.) Proceeds received $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts