Question: 4 . ( 4 0 points ) Upon graduation, you started your own investment company and received ( $ 1 , 0 0

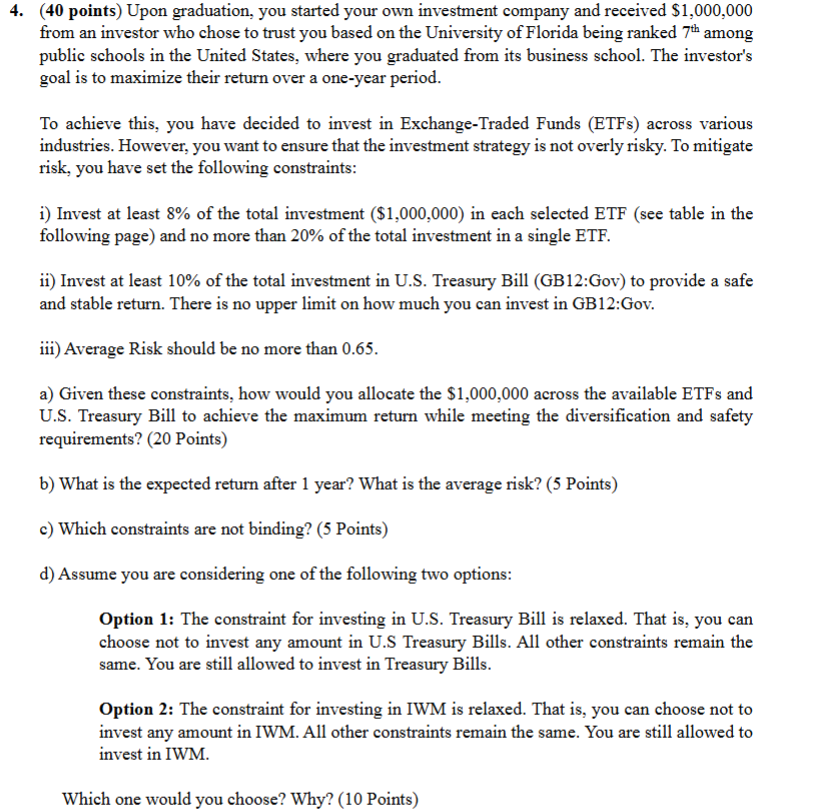

points Upon graduation, you started your own investment company and received $ from an investor who chose to trust you based on the University of Florida being ranked text th among public schools in the United States, where you graduated from its business school. The investor's goal is to maximize their return over a oneyear period.

To achieve this, you have decided to invest in ExchangeTraded Funds ETFs across various industries. However, you want to ensure that the investment strategy is not overly risky. To mitigate risk, you have set the following constraints:

i Invest at least of the total investment $ in each selected ETF see table in the following page and no more than of the total investment in a single ETF.

ii Invest at least of the total investment in US Treasury Bill GB:Gov to provide a safe and stable return. There is no upper limit on how much you can invest in GB:Gov.

iii Average Risk should be no more than

a Given these constraints, how would you allocate the $ across the available ETFs and US Treasury Bill to achieve the maximum return while meeting the diversification and safety requirements? Points

b What is the expected return after year? What is the average risk? Points

c Which constraints are not binding? Points

d Assume you are considering one of the following two options:

Option : The constraint for investing in US Treasury Bill is relaxed. That is you can choose not to invest any amount in US Treasury Bills. All other constraints remain the same. You are still allowed to invest in Treasury Bills.

Option : The constraint for investing in IWM is relaxed. That is you can choose not to invest any amount in IWM. All other constraints remain the same. You are still allowed to invest in IWM.

Which one would you choose? Why? Points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock