Question: 4 4 : 1 6 Time Remaining 1 1 Multiple Choice 2 points Tom lives in Kentucky where capital gains tax is higher than dividends

:

Time Remaining

Multiple Choice

points

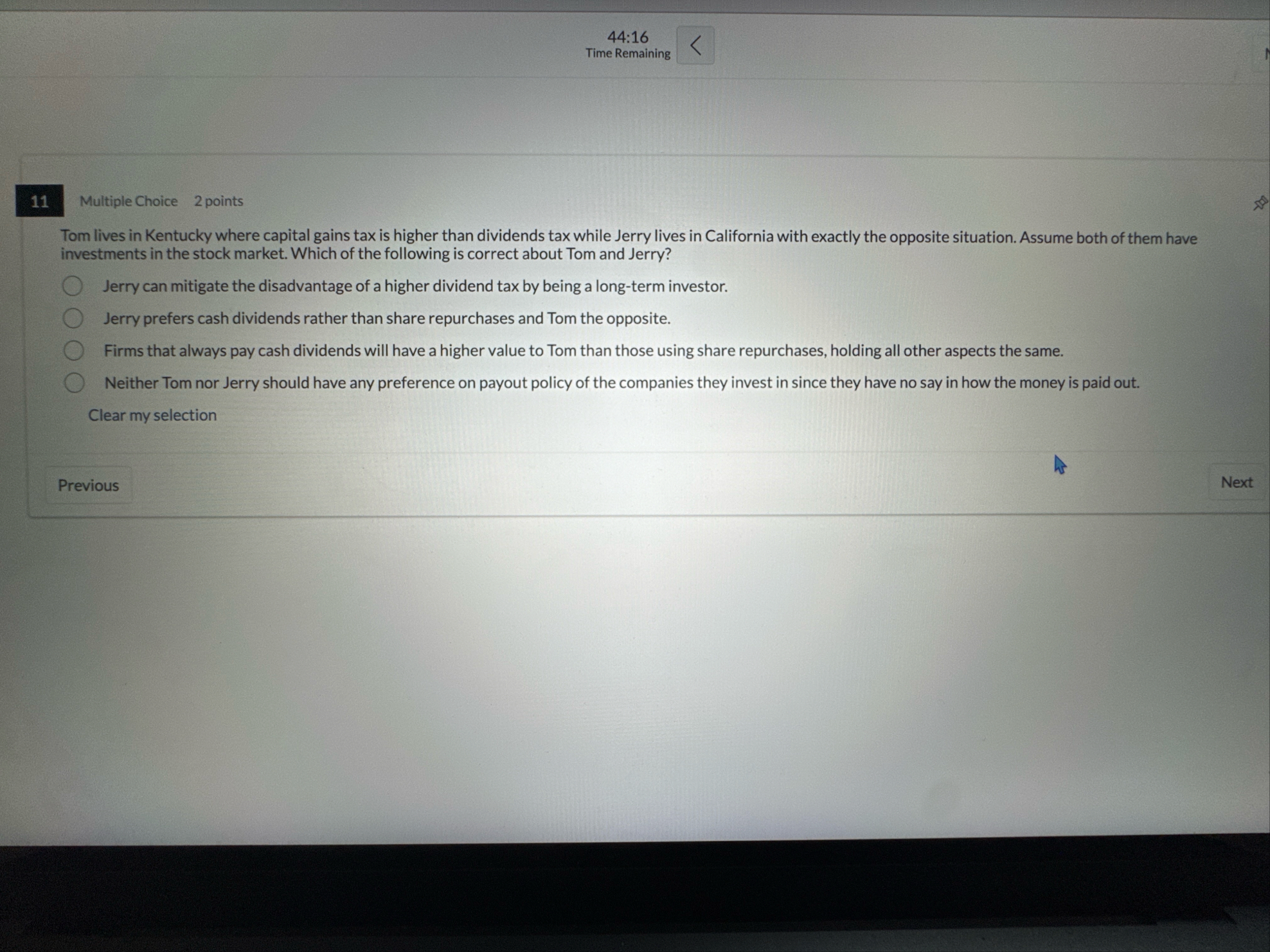

Tom lives in Kentucky where capital gains tax is higher than dividends tax while Jerry lives in California with exactly the opposite situation. Assume both of them have investments in the stock market. Which of the following is correct about Tom and Jerry?

Jerry can mitigate the disadvantage of a higher dividend tax by being a longterm investor.

Jerry prefers cash dividends rather than share repurchases and Tom the opposite.

Firms that always pay cash dividends will have a higher value to Tom than those using share repurchases, holding all other aspects the same.

Neither Tom nor Jerry should have any preference on payout policy of the companies they invest in since they have no say in how the money is paid out.

Clear my selection

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock