Question: 4 - 4 A - LO 3 See Example 4 - 4 on page 4 - 1 7 Eaton Enterprises uses the wage - bracket

A LO

See Example on page

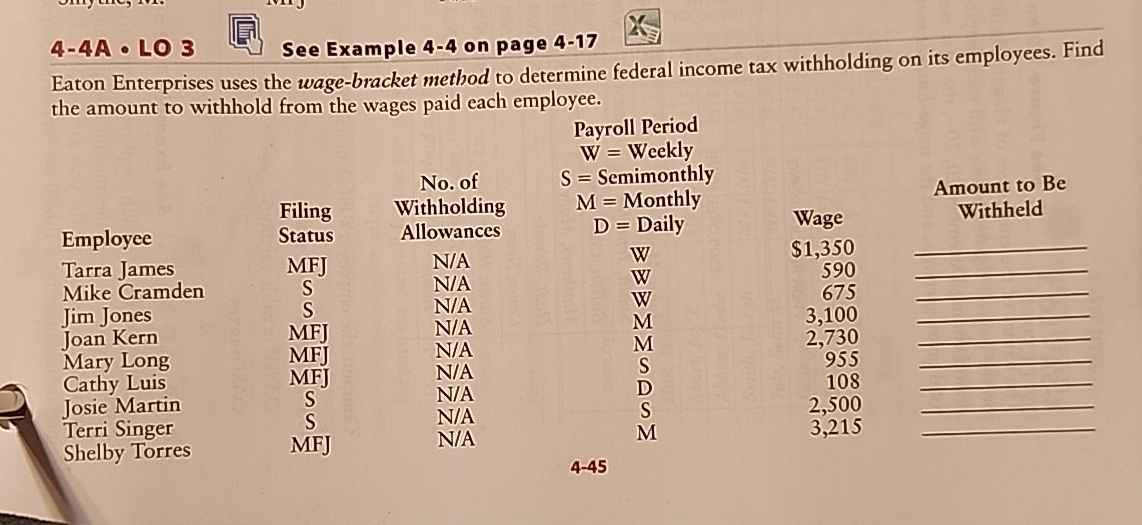

Eaton Enterprises uses the wagebracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee.

Payroll Period

W Weekly

No of Filing Withholding Status

Employee

Tarra James Mike Cramden Jim Jones

Joan Kern Mary Long Cathy Luis Josie Martin Terri Singer Shelby Torres

tableMFJNASNASNAMFJNAMFJNAMFJNASNASNAMFJNA

Semimonthly

Monthly

Daily

tableW$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock