Question: 4) 4) How much should you pay for a bond with $1,000 face value, a 14 percent coupon rate, and five years to maturity if

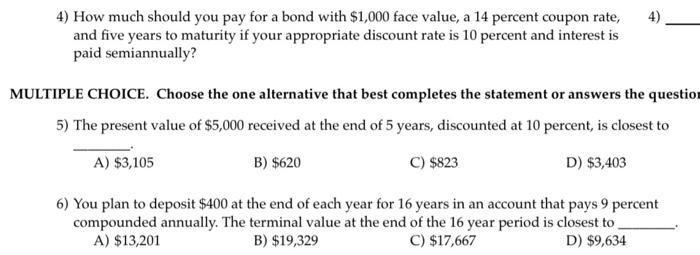

4) 4) How much should you pay for a bond with $1,000 face value, a 14 percent coupon rate, and five years to maturity if your appropriate discount rate is 10 percent and interest is paid semiannually? MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question 5) The present value of $5,000 received at the end of 5 years, discounted at 10 percent, is closest to A) $3,105 B) $620 C) $823 D) $3,403 6) You plan to deposit $400 at the end of each year for 16 years in an account that pays 9 percent compounded annually. The terminal value at the end of the 16 year period is closest to A) $13,201 B) $19,329 C) $17,667 D) $9,634

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts