Question: 4 4 P :5 4 P A trader buys a call and sells a put on an underlying asset with the same strike price and

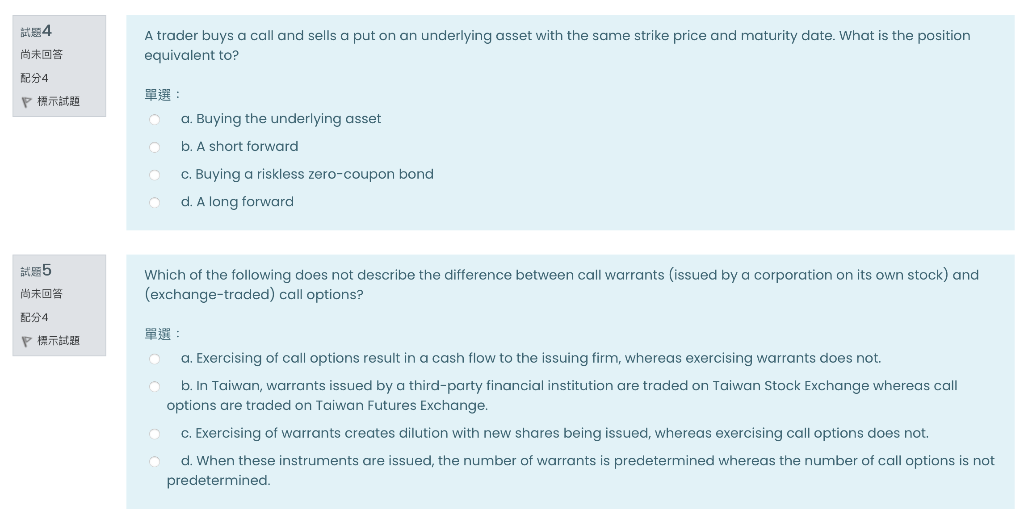

4 4 P :5 4 P A trader buys a call and sells a put on an underlying asset with the same strike price and maturity date. What is the position equivalent to? : O O O O a. Buying the underlying asset b. A short forward Which of the following does not describe the difference between call warrants (issued by a corporation on its own stock) and (exchange-traded) call options? O c. Buying a riskless zero-coupon bond d. A long forward : O a. Exercising of call options result in a cash flow to the issuing firm, whereas exercising warrants does not. O b. In Taiwan, warrants issued by a third-party financial institution are traded on Taiwan Stock Exchange whereas call options are traded on Taiwan Futures Exchange. c. Exercising of warrants creates dilution with new shares being issued, whereas exercising call options does not. d. When these instruments are issued, the number of warrants is predetermined whereas the number of call options is not predetermined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts