Question: 4 5 3 Assignment 4 Total marks 2 1 Note: Must show all work for full marks Question 1 ( 2 1 marks ) On

Assignment

Total marks

Note: Must show all work for full marks

Question marks

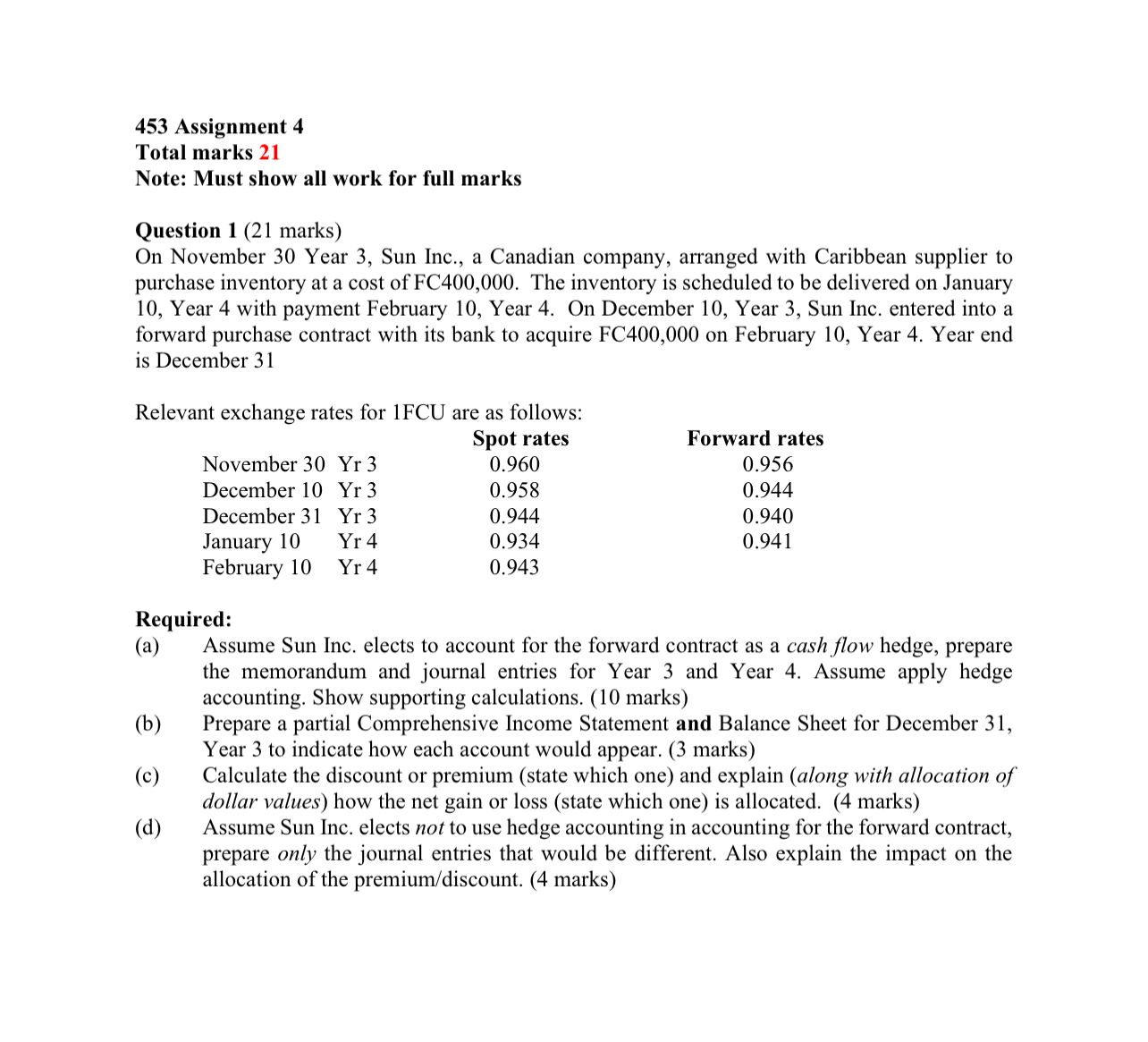

On November Year Sun Inc., a Canadian company, arranged with Caribbean supplier to purchase inventory at a cost of FC The inventory is scheduled to be delivered on January Year with payment February Year On December Year Sun Inc. entered into a forward purchase contract with its bank to acquire FC on February Year Year end is December

Relevant exchange rates for FCU are as follows:

tableSpot rates,Forward ratesNovember Yr December Yr December Yr January Yr February Yr

Required:

a Assume Sun Inc. elects to account for the forward contract as a cash flow hedge, prepare the memorandum and journal entries for Year and Year Assume apply hedge accounting. Show supporting calculations. marks

b Prepare a partial Comprehensive Income Statement and Balance Sheet for December Year to indicate how each account would appear. marks

c Calculate the discount or premium state which one and explain along with allocation of dollar values how the net gain or loss state which one is allocated. marks

d Assume Sun Inc. elects not to use hedge accounting in accounting for the forward contract, prepare only the journal entries that would be different. Also explain the impact on the allocation of the premiumdiscount marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock