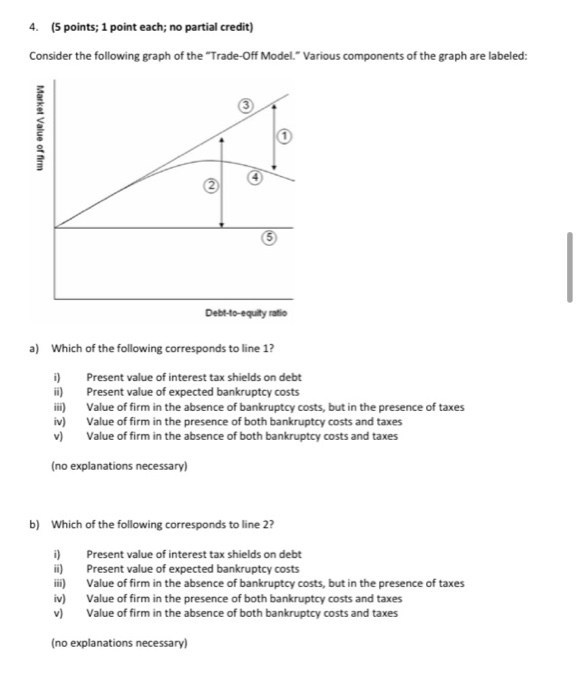

Question: 4. (5 points; 1 point each; no partial credit) Consider the following graph of the Trade-Off Model. Various components of the graph are labeled: Market

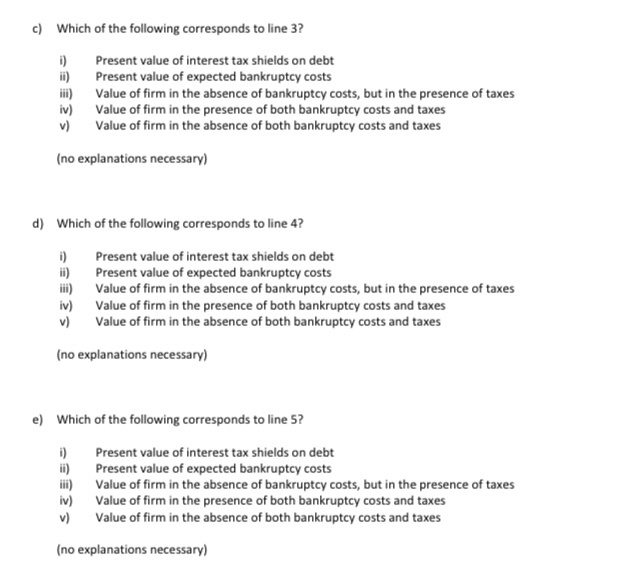

4. (5 points; 1 point each; no partial credit) Consider the following graph of the "Trade-Off Model." Various components of the graph are labeled: Market Value of firm Debt-to-equity ratio a) Which of the following corresponds to line 1? ii) iii) iv) Present value of interest tax shields on debt Present value of expected bankruptcy costs Value of firm in the absence of bankruptcy costs, but in the presence of taxes Value of firm in the presence of both bankruptcy costs and taxes Value of firm in the absence of both bankruptcy costs and taxes v) (no explanations necessary) b) Which of the following corresponds to line 2? i) ii) iii) iv) Present value of interest tax shields on debt Present value of expected bankruptcy costs Value of firm in the absence of bankruptcy costs, but in the presence of taxes Value of firm in the presence of both bankruptcy costs and taxes Value of firm in the absence of both bankruptcy costs and taxes (no explanations necessary) c) Which of the following corresponds to line 3? ii) 1) iv) v) Present value of interest tax shields on debt Present value of expected bankruptcy costs Value of firm in the absence of bankruptcy costs, but in the presence of taxes Value of firm in the presence of both bankruptcy costs and taxes Value of firm in the absence of both bankruptcy costs and taxes (no explanations necessary) d) Which of the following corresponds to line 4? Present value of interest tax shields on debt Present value of expected bankruptcy costs Value of firm in the absence of bankruptcy costs, but in the presence of taxes Value of firm in the presence of both bankruptcy costs and taxes Value of firm in the absence of both bankruptcy costs and taxes iv) v) (no explanations necessary) e) Which of the following corresponds to line 5? Present value of interest tax shields on debt Present value of expected bankruptcy costs Value of firm in the absence of bankruptcy costs, but in the presence of taxes Value of firm in the presence of both bankruptcy costs and taxes Value of firm in the absence of both bankruptcy costs and taxes iv) v) (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts