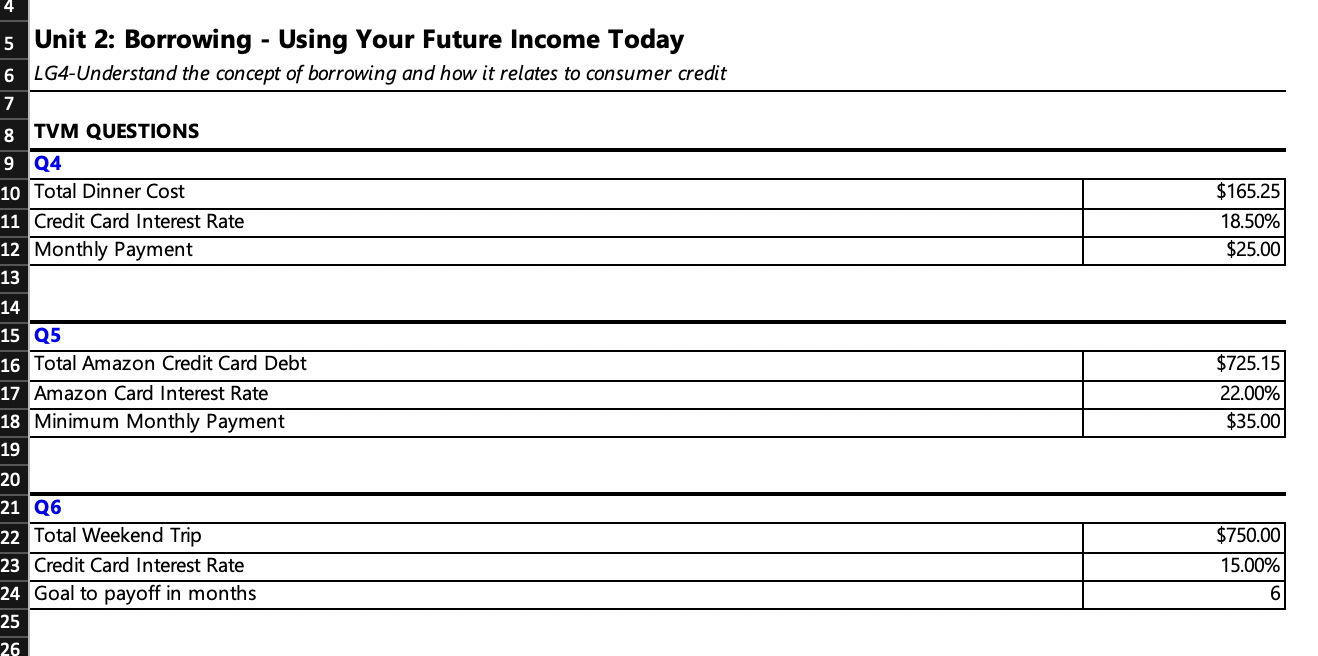

Question: 4 5 Unit 2: Borrowing - Using Your Future Income Today 6 LG4-Understand the concept of borrowing and how it relates to consumer credit 7

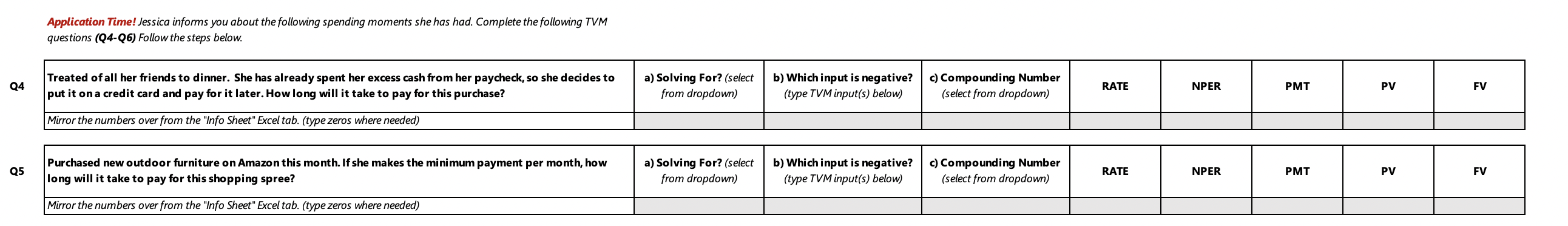

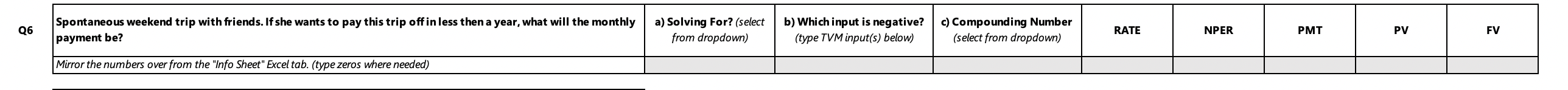

4 5 Unit 2: Borrowing - Using Your Future Income Today 6 LG4-Understand the concept of borrowing and how it relates to consumer credit 7 8 TVM QUESTIONS 9 Q4 10 Total Dinner Cost 11 Credit Card Interest Rate 12 Monthly Payment 13 $165.25 18.50% $25.00 14 15 Q5 16 Total Amazon Credit Card Debt 17 Amazon Card Interest Rate 18 Minimum Monthly Payment 19 $725.15 22.00% $35.00 20 $750.00 15.00% 21 Q6 22 Total Weekend Trip 23 Credit Card Interest Rate 24 Goal to payoff in months 25 26 6 Application Time! Jessica informs you about the following spending moments she has had. Complete the following TVM questions (04-06) Follow the steps below. Q4 Treated of all her friends to dinner. She has already spent her excess cash from her paycheck, so she decides to put it on a credit card and pay for it later. How long will it take to pay for this purchase? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q5 Purchased new outdoor furniture on Amazon this month. If she makes the minimum payment per month, how long will it take to pay for this shopping spree? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab.(type zeros where needed) Q6 Spontaneous weekend trip with friends. If she wants to pay this trip off in less then a year, what will the monthly payment be? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q7 What does this tell you about credit card usage? How could this impact Jessica's credit report/score? (min. 25 words) Q8 What is the risk of using a credit card? (min. 25 words) Q9 When is using a credit card a good thing? (min. 25 words) Q10 How can you use a credit card responsibly? (min. 25 words) 4 5 Unit 2: Borrowing - Using Your Future Income Today 6 LG4-Understand the concept of borrowing and how it relates to consumer credit 7 8 TVM QUESTIONS 9 Q4 10 Total Dinner Cost 11 Credit Card Interest Rate 12 Monthly Payment 13 $165.25 18.50% $25.00 14 15 Q5 16 Total Amazon Credit Card Debt 17 Amazon Card Interest Rate 18 Minimum Monthly Payment 19 $725.15 22.00% $35.00 20 $750.00 15.00% 21 Q6 22 Total Weekend Trip 23 Credit Card Interest Rate 24 Goal to payoff in months 25 26 6 Application Time! Jessica informs you about the following spending moments she has had. Complete the following TVM questions (04-06) Follow the steps below. Q4 Treated of all her friends to dinner. She has already spent her excess cash from her paycheck, so she decides to put it on a credit card and pay for it later. How long will it take to pay for this purchase? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q5 Purchased new outdoor furniture on Amazon this month. If she makes the minimum payment per month, how long will it take to pay for this shopping spree? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab.(type zeros where needed) Q6 Spontaneous weekend trip with friends. If she wants to pay this trip off in less then a year, what will the monthly payment be? a) Solving For? (select from dropdown) b) Which input is negative? (type TVM input(s) below) c) Compounding Number (select from dropdown) RATE NPER PMT PV FV Mirror the numbers over from the "Info Sheet" Excel tab. (type zeros where needed) Q7 What does this tell you about credit card usage? How could this impact Jessica's credit report/score? (min. 25 words) Q8 What is the risk of using a credit card? (min. 25 words) Q9 When is using a credit card a good thing? (min. 25 words) Q10 How can you use a credit card responsibly? (min. 25 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts