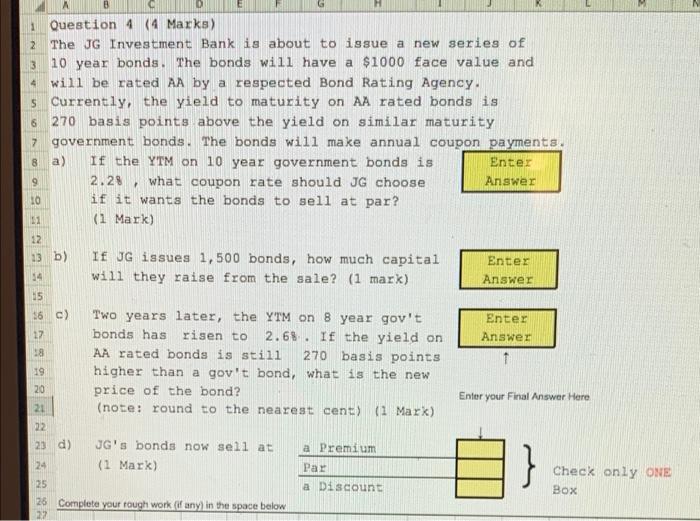

Question: 4 6 ON V 8 9 Question 4 (4 Marks) 2 The JG Investment Bank is about to issue a new series of 3 10

4 6 ON V 8 9 Question 4 (4 Marks) 2 The JG Investment Bank is about to issue a new series of 3 10 year bonds. The bonds will have a $1000 face value and will be rated AA by a respected Bond Rating Agency. s currently, the yield to maturity on AA rated bonds is 270 basis points above the yield on similar maturity 7 government bonds. The bonds will make annual coupon payments. a) If the YTM on 10 year government bonds is Enter 2.28. what coupon rate should JG choose Answer 10 if it wants the bonds to sell at par? 1 (1 Mark) 12 13 b) If JG issues 1,500 bonds, how much capital Enter will they raise from the sale? (1 mark) Answer 15 36 c) Two years later, the YTM on 8 year gov't Enter 17 bonds has risen to 2.6%. If the yield on Answer 58 AA rated bonds is still 270 basis points 1 19 higher than a gov't bond, what is the new 20 price of the bond? Enter your Final Answer Here 21 (note: round to the nearest cent) (1 Mark) 02 23 d) JG's bonds now sell at a Premium 24 (1 Mark) Check only ONE 25 a Discount Box 25 Complete your rough work (if any) in the space below 22 Par }

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts