Question: 4. ( 69 points) Answer the following: A. A project will pay the following amounts for the next 4 years. If the minimum attractive rate

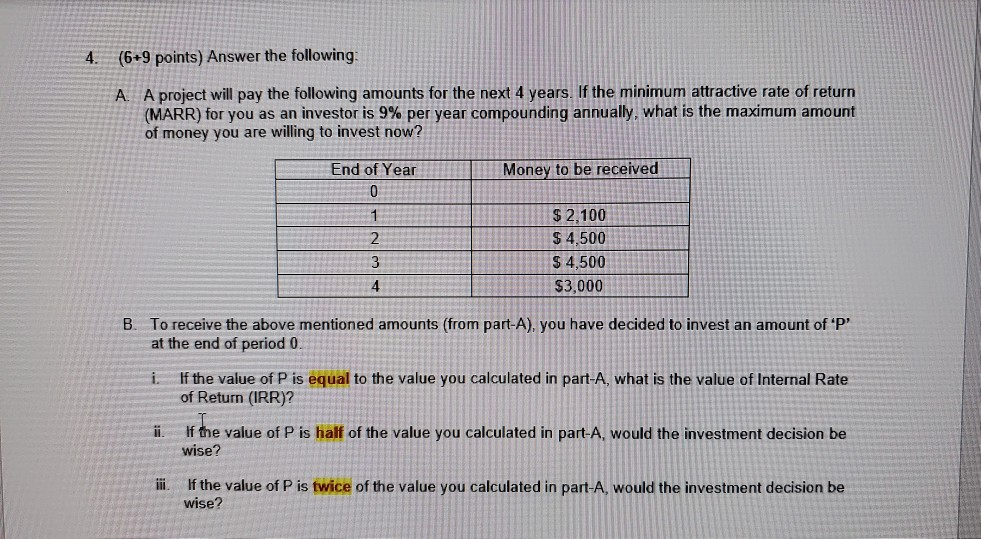

4. ( 69 points) Answer the following: A. A project will pay the following amounts for the next 4 years. If the minimum attractive rate of return (MARR) for you as an investor is 9% per year compounding annually, what is the maximum amount of money you are willing to invest now? End of Year Money to be received NO $ 2,100 $ 4,500 $ 4,500 $3,000 B. To receive the above mentioned amounts (from part-A), you have decided to invest an amount of 'P at the end of period 0. i. If the value of P is equal to the value you calculated in part-A, what is the value of Internal Rate of Return (IRR)? ii. If the value of P is half of the value you calculated in part-A, would the investment decision be wise? ii. If the value of P is twice of the value you calculated in part-A, would the investment decision be wise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts