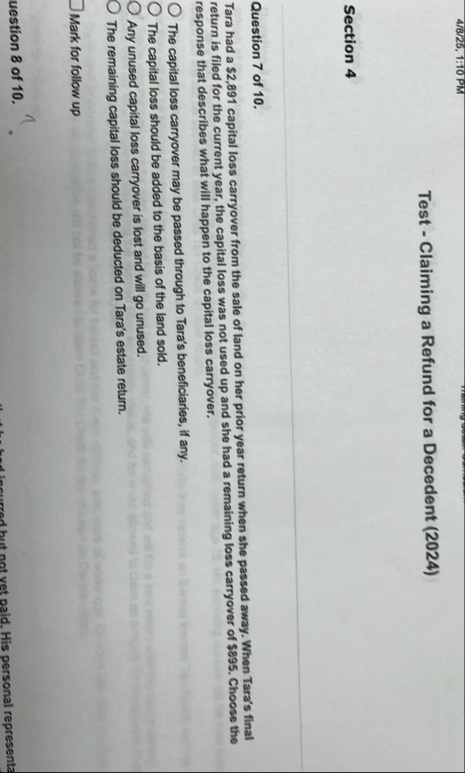

Question: 4 / 8 / 2 5 , 1 : 1 0 PM Test - Claiming a Refund for a Decedent ( 2 0 2 4

: PM

Test Claiming a Refund for a Decedent

Section

Question of

Tara had a $ capital loss carryover from the sale of land on her prior year return when she passed away. When Tara's final return is filed for the current year, the capital loss was not used up and she had a remaining loss carryover of $ Choose the response that describes what will happen to the capital loss carryover.

The capital loss carryover may be passed through to Tara's beneficiaries, if any.

The capital loss should be added to the basis of the land sold.

Any unused capital loss carryover is lost and will go unused.

The remaining capital loss should be deducted on Tara's estate return.

Mark for follow up

uestion of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock