Question: 4. (8 marks) Explain why portfolio risk (Op) tends to decrease as the number of stocks in the portfolio increases. Key concepts to include in

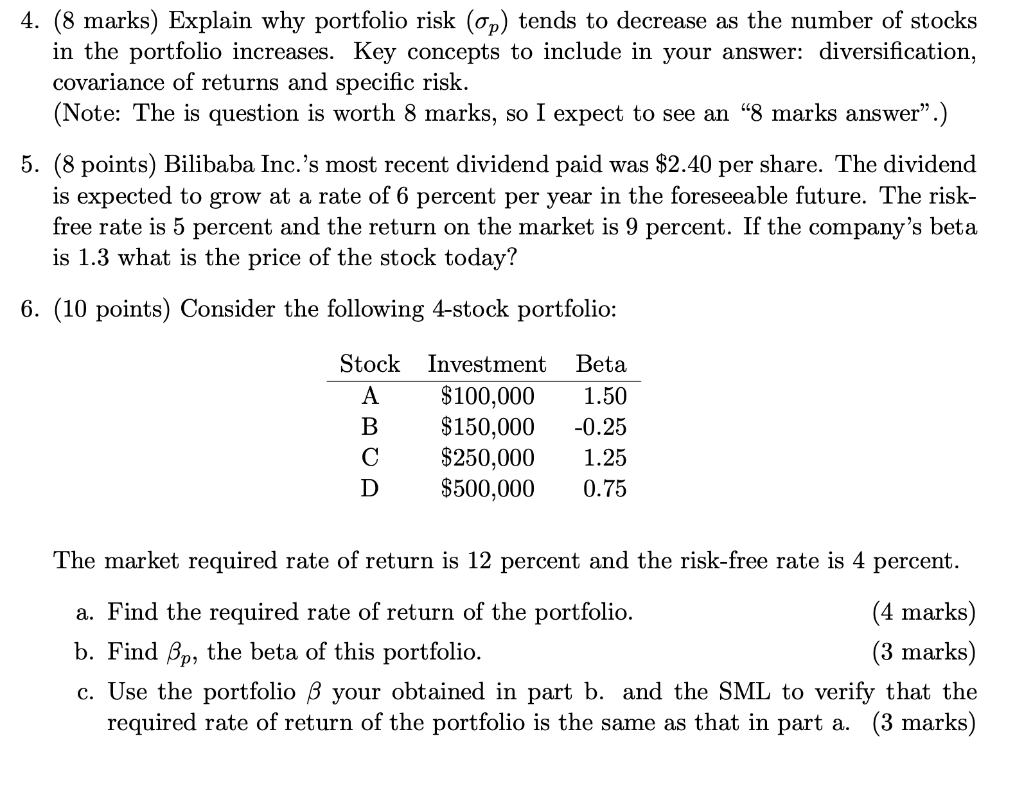

4. (8 marks) Explain why portfolio risk (Op) tends to decrease as the number of stocks in the portfolio increases. Key concepts to include in your answer: diversification, covariance of returns and specific risk. (Note: The is question is worth 8 marks, so I expect to see an 8 marks answer.) 5. (8 points) Bilibaba Inc.'s most recent dividend paid was $2.40 per share. The dividend is expected to grow at a rate of 6 percent per year in the foreseeable future. The risk- free rate is 5 percent and the return on the market is 9 percent. If the company's beta is 1.3 what is the price of the stock today? 6. (10 points) Consider the following 4-stock portfolio: Stock A B Investment $100,000 $150,000 $250,000 $500,000 Beta 1.50 -0.25 1.25 0.75 C D The market required rate of return is 12 percent and the risk-free rate is 4 percent. a. Find the required rate of return of the portfolio. (4 marks) b. Find Bp, the beta of this portfolio. (3 marks) c. Use the portfolio B your obtained in part b. and the SML to verify that the required rate of return of the portfolio is the same as that in part a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts