Question: 4. (8 points) Logan Inc., a U.S. multinational, is considering a project in France that would be financed with 40% debt and 60% equity.

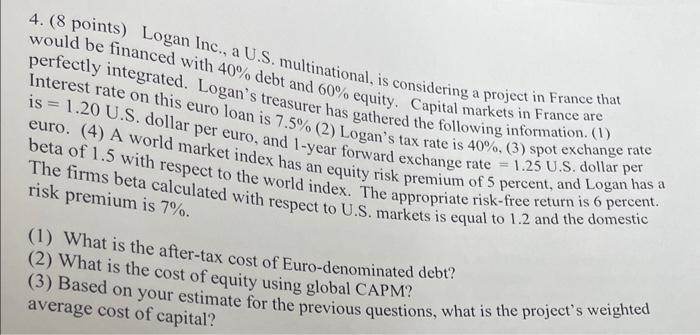

4. (8 points) Logan Inc., a U.S. multinational, is considering a project in France that would be financed with 40% debt and 60% equity. Capital markets in France are perfectly integrated. Logan's treasurer has gathered the following information. (1) Interest rate on this euro loan is 7.5% (2) Logan's tax rate is 40%, (3) spot exchange rate is 1.20 U.S. dollar per euro, and 1-year forward exchange rate = 1.25 U.S. dollar per euro. (4) A world market index has an equity risk premium of 5 percent, and Logan has a beta of 1.5 with respect to the world index. The appropriate risk-free return is 6 percent. The firms beta calculated with respect to U.S. markets is equal to 1.2 and the domestic risk premium is 7%. (1) What is the after-tax cost of Euro-denominated debt? (2) What is the cost of equity using global CAPM? (3) Based on your estimate for the previous questions, what is the project's weighted average cost of capital?

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

1 The aftertax cost of Eurodenominated debt can be calculated as follows Afte... View full answer

Get step-by-step solutions from verified subject matter experts