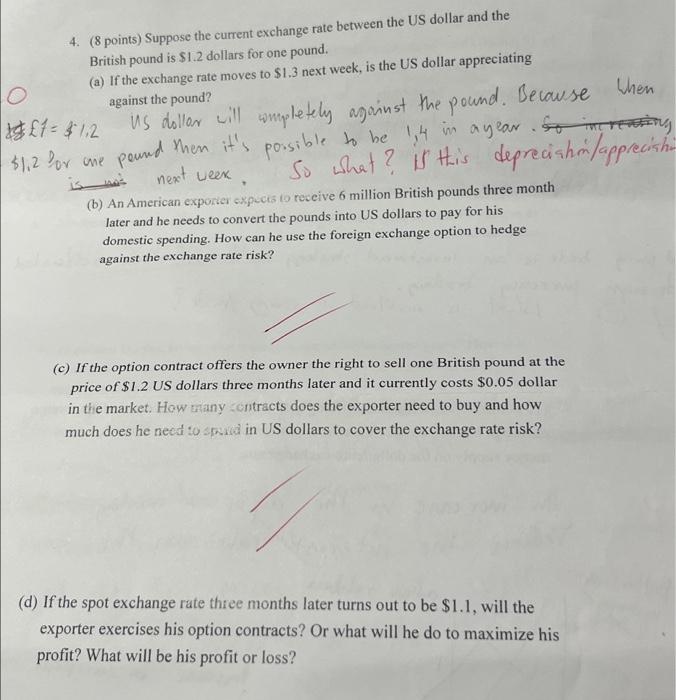

Question: 4. (8 points) Suppose the current exchange rate between the US dollar and the British pound is $1.2 dollars for one pound. (a) If the

4. (8 points) Suppose the current exchange rate between the US dollar and the British pound is $1.2 dollars for one pound. (a) If the exchange rate moves to $1.3 next week, is the US dollar appreciating Iff =$1,2 WS dollor will wmpletely against the pound. Because against the pound? 51.2 lor one pound then it's po.sible to be 1,4 im a year. is next veex. So what? It this deprecishm (b) An American exporier cxpucis to receive 6 million British pounds three month later and he needs to convert the pounds into US dollars to pay for his domestic spending. How can he use the foreign exchange option to hedge against the exchange rate risk? (c) If the option contract offers the owner the right to sell one British pound at the price of $1.2 US dollars three months later and it currently costs $0.05 dollar in the market. How many sentracts does the exporter need to buy and how much does he neod to spid in US dollars to cover the exchange rate risk? (d) If the spot exchange rate three months later turns out to be $1.1, will the exporter exercises his option contracts? Or what will he do to maximize his profit? What will be his profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts