Question: 4 8. State whether each situation is a deferral or an accrual. Part A: a. Unrecorded interest that has been earned on savings bonds is

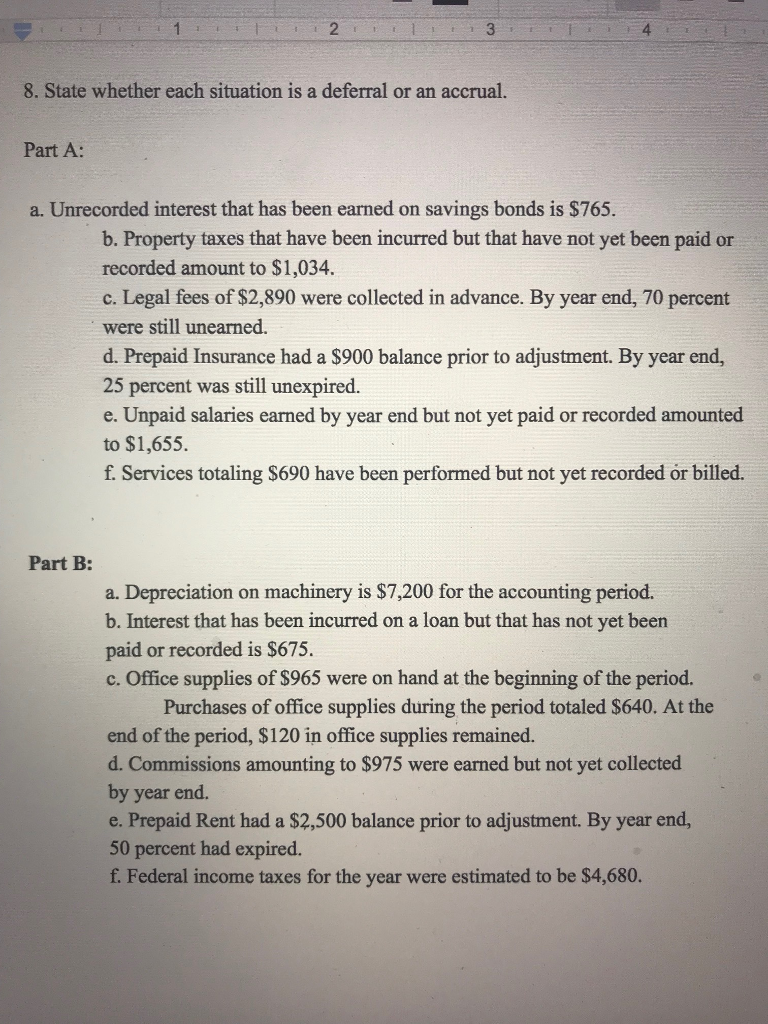

4 8. State whether each situation is a deferral or an accrual. Part A: a. Unrecorded interest that has been earned on savings bonds is $765. b. Property taxes that have been incurred but that have not yet been paid or recorded amount to $1,034 c. Legal fees of $2,890 were collected in advance. By year end, 70 percent were still unearned. d. Prepaid Insurance had a $900 balance prior to adjustment. By year end, 25 percent was still unexpired. e. Unpaid salaries earned by year end but not yet paid or recorded amounted to $1,655. f. Services totaling $690 have been performed but not yet recorded or billed. Part B: a. Depreciation on machinery is $7,200 for the accounting period. b. Interest that has been incurred on a loan but that has not yet been paid or recorded is $675. c. Office supplies of S965 were on hand at the beginning of the period. Purchases of office supplies during the period totaled $640. At the end of the period, $120 in office supplies remained. d. Commissions amounting to $975 were earned but not yet collected by year end. e. Prepaid Rent had a $2,500 balance prior to adjustment. By year end, 50 percent had expired. f. Federal income taxes for the year were estimated to be $4,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts