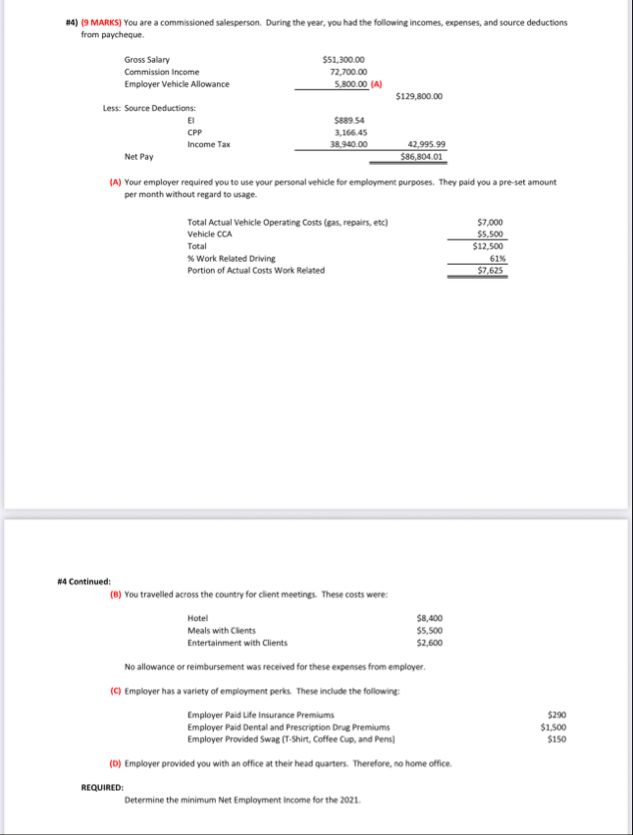

Question: # 4 ) ( 9 MARKS ) You are a commissioned salesperson. During the year, you had the following incomes, expenses, and source deductions from

# MARKS You are a commissioned salesperson. During the year, you had the following incomes, expenses, and source deductions from paycheque.

tableGross Salary,$Commission Income,Employer Vehicle Allowance,A$Less: Source Deductions:EI$CPPIncome Tax,Net Pay,,$

A Your employer required you to use your personal vehicle for employment purposes. They paid you a preset amount per month without regard to usage.

tableTotal Actual Vehicle Operating Costs gas repairs, etc$Vehicle CCA,$Total$ Work Related Driving,Portion of Actual Costs Work Related,$

# Continued:

B You travelled across the country for client meetings. These costs were:

tableHotel$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock