Question: 4. (9 points) Effect of Valuation Method for Nonmonetary Asset on Balance Sheet and Income Statement. Assume Target acquires a tract of land on January

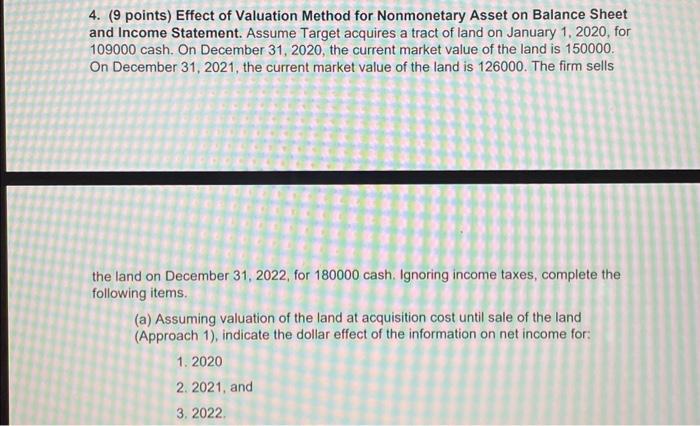

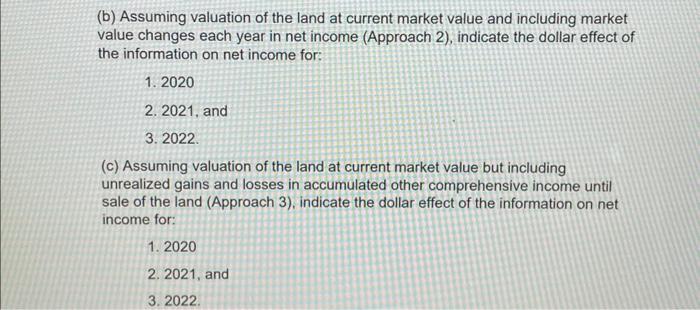

4. (9 points) Effect of Valuation Method for Nonmonetary Asset on Balance Sheet and Income Statement. Assume Target acquires a tract of land on January 1,2020, for 109000 cash. On December 31, 2020, the current market value of the land is 150000. On December 31,2021 , the current market value of the land is 126000 . The firm sells the land on December 31, 2022, for 180000 cash. Ignoring income taxes, complete the following items. (a) Assuming valuation of the land at acquisition cost until sale of the land (Approach 1), indicate the dollar effect of the information on net income for: 1. 2020 2. 2021, and 3. 2022 . (b) Assuming valuation of the land at current market value and including market value changes each year in net income (Approach 2), indicate the dollar effect of the information on net income for: 1. 2020 2. 2021, and 3. 2022. (c) Assuming valuation of the land at current market value but including unrealized gains and losses in accumulated other comprehensive income until sale of the land (Approach 3), indicate the dollar effect of the information on net income for: 1. 2020 2. 2021 , and 3. 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts