Question: #4) A 40-year-old 50 unit apartment complex in a transitional neighborhood is for sale in Atlanta for $3,000,000. Using the financials below what is the

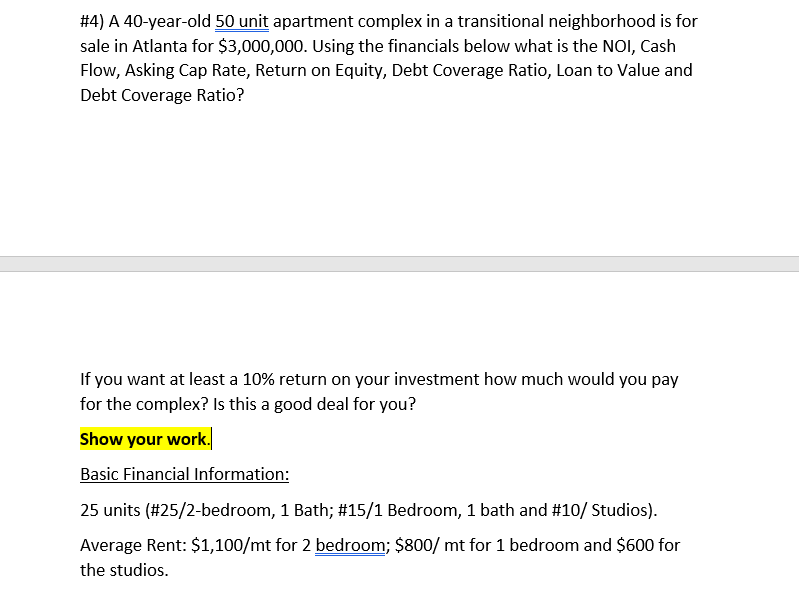

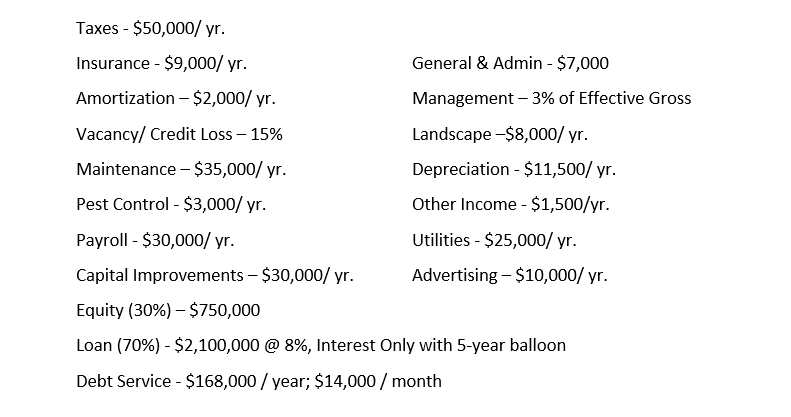

#4) A 40-year-old 50 unit apartment complex in a transitional neighborhood is for sale in Atlanta for $3,000,000. Using the financials below what is the NOI, Cash Flow, Asking Cap Rate, Return on Equity, Debt Coverage Ratio, Loan to Value and Debt Coverage Ratio? If you want at least a 10% return on your investment how much would you pay for the complex? Is this a good deal for you? Show your work. Basic Financial Information: 25 units (#25/2-bedroom, 1 Bath; #15/1 Bedroom, 1 bath and #10/ Studios). Average Rent: $1,100/mt for 2 bedroom; $800/ mt for 1 bedroom and $600 for the studios. Taxes - $50,000/ yr. Insurance - $9,000/ yr. General & Admin - $7,000 Amortization - $2,000/ yr. Management -3% of Effective Gross Vacancy/ Credit Loss 15% Landscape -$8,000/ yr. Maintenance - $35,000/ yr. Depreciation - $11,500/ yr. Pest Control - $3,000/ yr. Other Income - $1,500/yr. Payroll - $30,000/ yr. Utilities - $25,000/ yr. Capital Improvements - $30,000/ yr. Advertising - $10,000/ yr. Equity (30%) - $750,000 Loan (70%) - $2,100,000 @ 8%, Interest Only with 5-year balloon Debt Service - $168,000 / year; $14,000 / month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts