Question: 4) A. An analyst invests in a portfolio, he seeks to determine the risk on his investment, after a careful research, the analyst made his

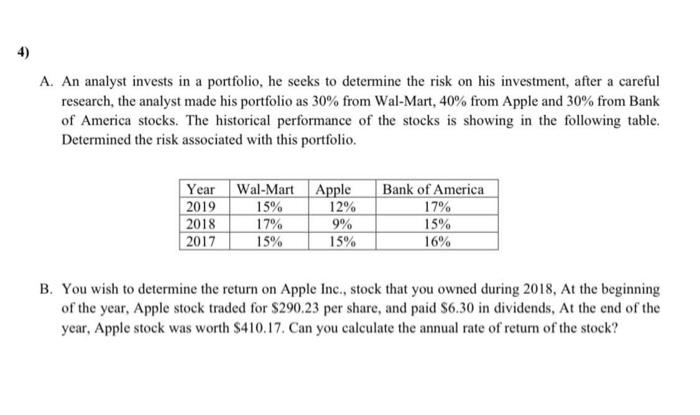

4) A. An analyst invests in a portfolio, he seeks to determine the risk on his investment, after a careful research, the analyst made his portfolio as 30% from Wal-Mart, 40% from Apple and 30% from Bank of America stocks. The historical performance of the stocks is showing in the following table. Determined the risk associated with this portfolio. Year Wal-Mart 2019 15% 2018 17% 2017 15% Apple 12% 9% 15% Bank of America 17% 15% 16% B. You wish to determine the return on Apple Inc., stock that you owned during 2018, At the beginning of the year, Apple stock traded for $290.23 per share, and paid $6.30 in dividends. At the end of the year, Apple stock was worth $410.17. Can you calculate the annual rate of return of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts