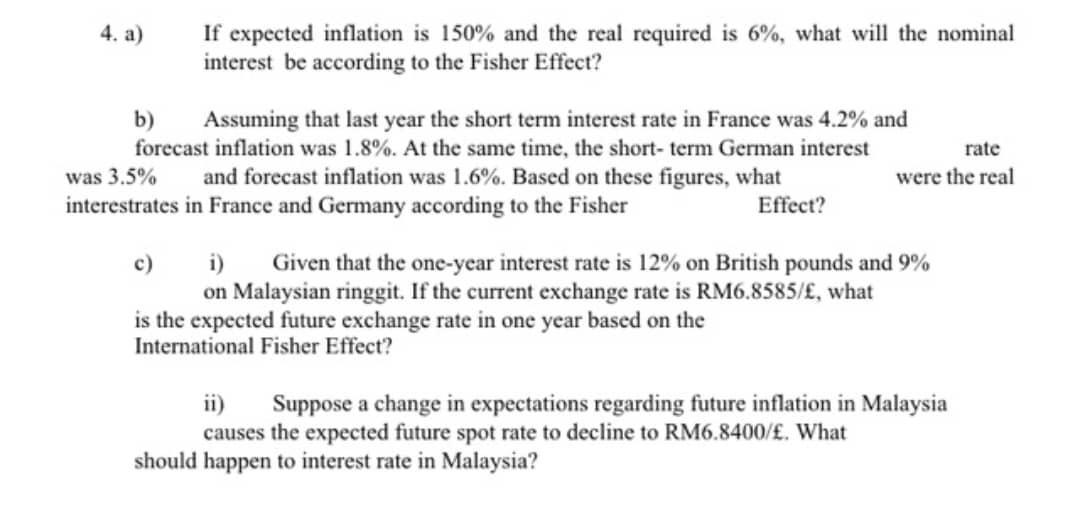

Question: 4. a) b) If expected inflation is 150% and the real required is 6%, what will the nominal interest be according to the Fisher

4. a) b) If expected inflation is 150% and the real required is 6%, what will the nominal interest be according to the Fisher Effect? Assuming that last year the short term interest rate in France was 4.2% and forecast inflation was 1.8%. At the same time, the short-term German interest was 3.5% and forecast inflation was 1.6%. Based on these figures, what interestrates in France and Germany according to the Fisher c) i) Effect? rate were the real Given that the one-year interest rate is 12% on British pounds and 9% on Malaysian ringgit. If the current exchange rate is RM6.8585/, what is the expected future exchange rate in one year based on the International Fisher Effect? ii) Suppose a change in expectations regarding future inflation in Malaysia causes the expected future spot rate to decline to RM6.8400/. What should happen to interest rate in Malaysia?

Step by Step Solution

There are 3 Steps involved in it

a If expected inflation is 150 and the real required rate is 6 the nominal interest rate according t... View full answer

Get step-by-step solutions from verified subject matter experts