Question: 4. a) b) Name any three major specific risks that Hedge Funds are exposed to. [6 marks] A hedge fund is long $350 million in

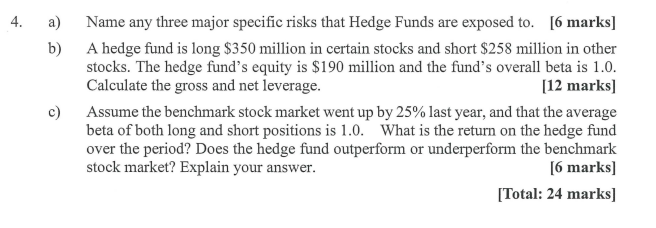

4. a) b) Name any three major specific risks that Hedge Funds are exposed to. [6 marks] A hedge fund is long $350 million in certain stocks and short $258 million in other stocks. The hedge fund's equity is $190 million and the fund's overall beta is 1.0. Calculate the gross and net leverage. [12 marks] Assume the benchmark stock market went up by 25% last year, and that the average beta of both long and short positions is 1.0. What is the return on the hedge fund over the period? Does the hedge fund outperform or underperform the benchmark stock market? Explain your answer. [6 marks] [Total: 24 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts