Question: 4. a) Construct a decision tree to help Debbie in her decision. Which option is the best for her? [30%] Debbie Gibson is considering four

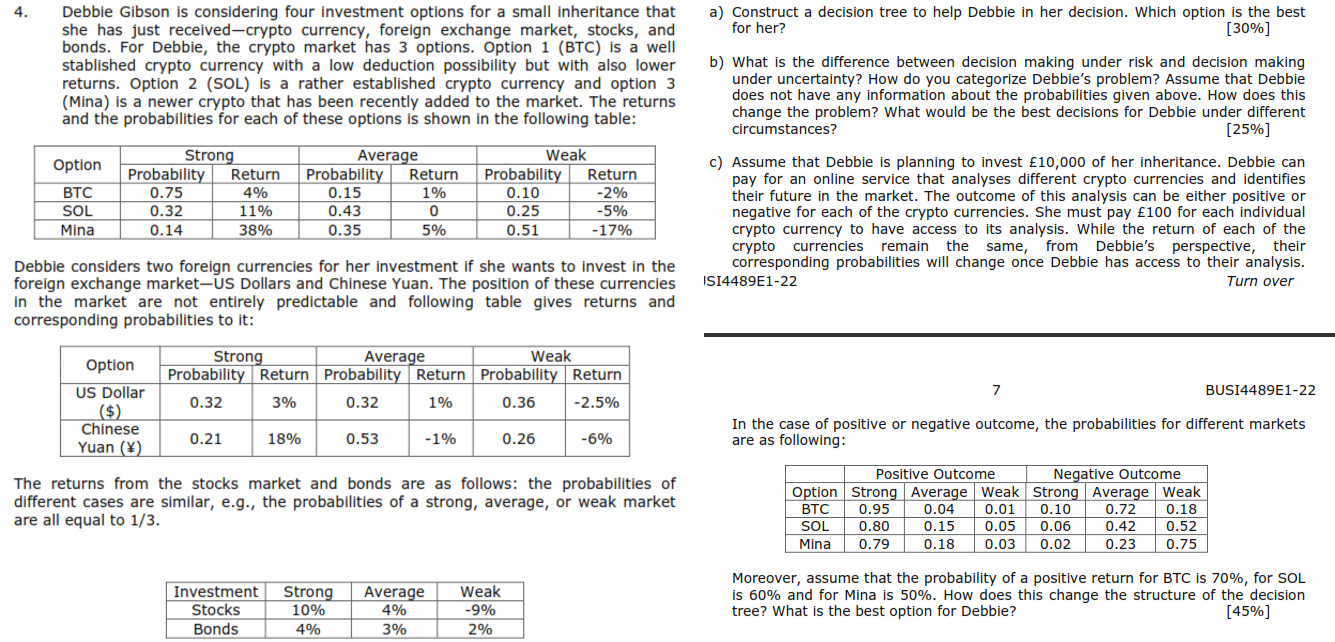

4. a) Construct a decision tree to help Debbie in her decision. Which option is the best for her? [30%] Debbie Gibson is considering four investment options for a small inheritance that she has just received-crypto currency, foreign exchange market, stocks, and bonds. For Debbie, the crypto market has 3 options. Option 1 (BTC) is a well stablished crypto currency with a low deduction possibility but with also lower returns. Option 2 (SOL) is a rather established crypto currency and option 3 (Mina) is a newer crypto that has been recently added to the market. The returns and the probabilities for each of these options is shown in the following table: Option BTC SOL Mina Strong Probability Return 0.75 4% 0.32 11% 0.14 38% Average Probability Return 0.15 1% 0.43 0 0.35 5% Weak Probability Return 0.10 0.25 -5% 0.51 -17% b) What is the difference between decision making under risk and decision making under uncertainty? How do you categorize Debbie's problem? Assume that Debbie does not have any information about the probabilities given above. How does this change the problem? What would be the best decisions for Debbie under different circumstances? [25%] c) Assume that Debbie is planning to invest 10,000 of her inheritance. Debbie can pay for an online service that analyses different crypto currencies and identifies their future in the market. The outcome of this analysis can be either positive or negative for each of the crypto currencies. She must pay 100 for each individual crypto currency to have access to its analysis. While the return of each of the cryptocurrencies remain the same, from Debbie's perspective, their corresponding probabilities will change once Debbie has access to their analysis. IS14489E1-22 Turn over -2% Debbie considers two foreign currencies for her investment if she wants to invest in the foreign exchange market - US Dollars and Chinese Yuan. The position of these currencies in the market are not entirely predictable and following table gives returns and corresponding probabilities to it: Strong Average Weak Probability Return Probability Return Probability Return 0.32 3% 0.32 1% 0.36 -2.5% 7 Option US Dollar ($) Chinese Yuan () BUSI4489E1-22 0.21 18% 0.53 -1% 0.26 In the case of positive or negative outcome, the probabilities for different markets are as following: -6% The returns from the stocks market and bonds are as follows: the probabilities of different cases are similar, e.g., the probabilities of a strong, average, or weak market are all equal to 1/3. Positive Outcome Negative Outcome Option Strong Average Weak Strong Average Weak BTC 0.95 0.04 0.01 0.10 0.72 0.18 SOL 0.80 0.15 0.05 0.06 0.42 0.52 Mina 0.79 0.18 0.03 0.02 0.23 0.75 Investment Stocks Bonds Strong 10% 4% Average 4% Weak -9% 2% Moreover, assume that the probability of a positive return for BTC is 70%, for SOL is 60% and for Mina is 50%. How does this change the structure of the decision tree? What is the best option for Debbie? [45%] 3% 4. a) Construct a decision tree to help Debbie in her decision. Which option is the best for her? [30%] Debbie Gibson is considering four investment options for a small inheritance that she has just received-crypto currency, foreign exchange market, stocks, and bonds. For Debbie, the crypto market has 3 options. Option 1 (BTC) is a well stablished crypto currency with a low deduction possibility but with also lower returns. Option 2 (SOL) is a rather established crypto currency and option 3 (Mina) is a newer crypto that has been recently added to the market. The returns and the probabilities for each of these options is shown in the following table: Option BTC SOL Mina Strong Probability Return 0.75 4% 0.32 11% 0.14 38% Average Probability Return 0.15 1% 0.43 0 0.35 5% Weak Probability Return 0.10 0.25 -5% 0.51 -17% b) What is the difference between decision making under risk and decision making under uncertainty? How do you categorize Debbie's problem? Assume that Debbie does not have any information about the probabilities given above. How does this change the problem? What would be the best decisions for Debbie under different circumstances? [25%] c) Assume that Debbie is planning to invest 10,000 of her inheritance. Debbie can pay for an online service that analyses different crypto currencies and identifies their future in the market. The outcome of this analysis can be either positive or negative for each of the crypto currencies. She must pay 100 for each individual crypto currency to have access to its analysis. While the return of each of the cryptocurrencies remain the same, from Debbie's perspective, their corresponding probabilities will change once Debbie has access to their analysis. IS14489E1-22 Turn over -2% Debbie considers two foreign currencies for her investment if she wants to invest in the foreign exchange market - US Dollars and Chinese Yuan. The position of these currencies in the market are not entirely predictable and following table gives returns and corresponding probabilities to it: Strong Average Weak Probability Return Probability Return Probability Return 0.32 3% 0.32 1% 0.36 -2.5% 7 Option US Dollar ($) Chinese Yuan () BUSI4489E1-22 0.21 18% 0.53 -1% 0.26 In the case of positive or negative outcome, the probabilities for different markets are as following: -6% The returns from the stocks market and bonds are as follows: the probabilities of different cases are similar, e.g., the probabilities of a strong, average, or weak market are all equal to 1/3. Positive Outcome Negative Outcome Option Strong Average Weak Strong Average Weak BTC 0.95 0.04 0.01 0.10 0.72 0.18 SOL 0.80 0.15 0.05 0.06 0.42 0.52 Mina 0.79 0.18 0.03 0.02 0.23 0.75 Investment Stocks Bonds Strong 10% 4% Average 4% Weak -9% 2% Moreover, assume that the probability of a positive return for BTC is 70%, for SOL is 60% and for Mina is 50%. How does this change the structure of the decision tree? What is the best option for Debbie? [45%] 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts