Question: 4. (a) Distinguish between compounding and discounting. Find the present value of Taka 1000 due in five years under each of the following conditions: compounded

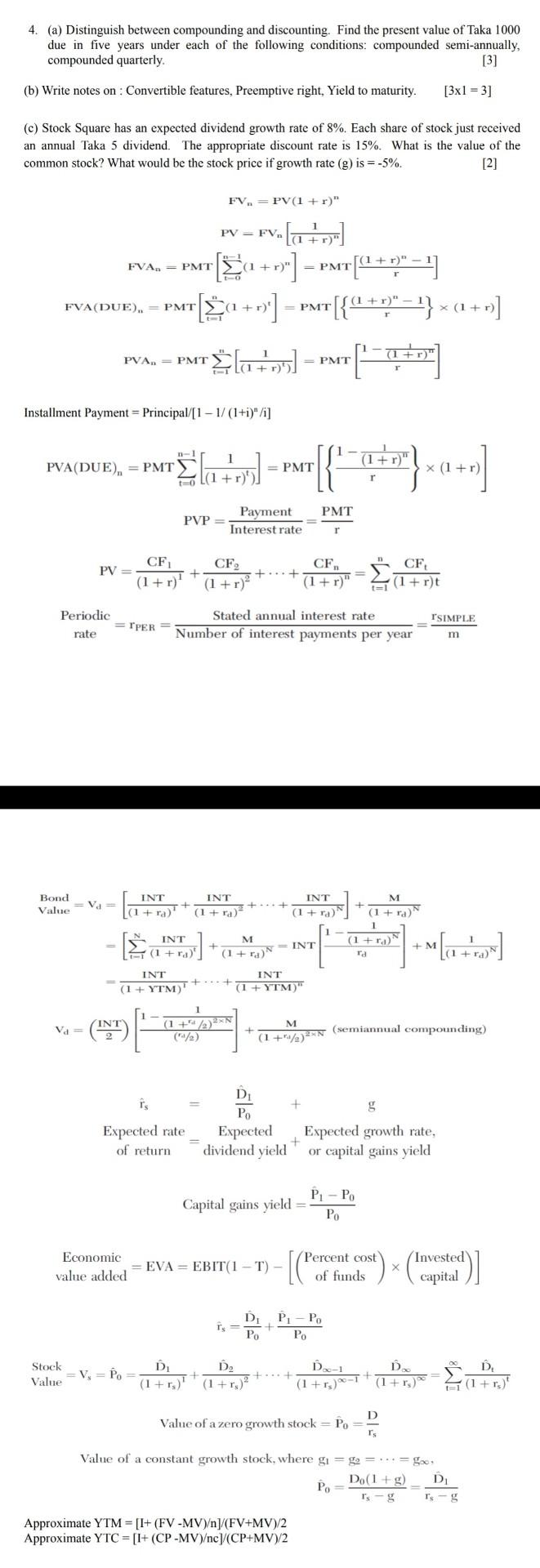

4. (a) Distinguish between compounding and discounting. Find the present value of Taka 1000 due in five years under each of the following conditions: compounded semi-annually, compounded quarterly. (3) (b) Write notes on : Convertible features, Preemptive right, Yield to maturity. [3x1 = 3] (c) Stock Square has an expected dividend growth rate of 8%. Each share of stock just received an annual Taka 5 dividend. The appropriate discount rate is 15%. What is the value of the common stock? What would be the stock price if growth rate (g) is = -5%. [2] FV.. = PV(1 + r)" PV = FV. (1+r)" FVA - PMT (1+ [(1 + r)" = PMT FVA(DUE). = PMT (1+ PMT X - [4"= PMT3a +r] =rut[{^ +1}"} * (1+rs] [' +r5] [ +1) PVA. = PMT 1 AL(1+r)! = PMT Installment Payment Principal/[1-1/(1+i)" /] TEL PVA(DUE).= PMT to] (1+r)" 1 +r)') [{ = PMT X (1+r) (1 PMT PVP Payment Interest rate r CF PV = (1 + r)' + CF2 (1 + r) CF. + (1 + r)" _CF = (1+r)t Periodic = I PER rate Stated annual interest rate Number of interest payments per year I'SIMPLE m Bond Value Vaa [41 INT (+) INT (1 + r) INT (1 + 4). M (1+ ra) M N INT la (1+r)* + INT (1+r) +M (1+r)* INT (1 + YTM)' INT (1 + YTM)" INT Va= (1+2) (2) M (1 +22N (semiannual compounding) f's + g Expected rate of return D Po Expected dividend yield Expected growth rate, or capital gains yield Capital gains yield PL - PO Po Economic value added EVA = EBIT(1-T) - [C (Percent cost of funds **) * ()] X Invested capital P r D Po Po Stock Value V = PO Di (1 + r) DA (1+r) D-1 D (1 +13)-1*(1 + r) D. (1+r) D Value of a zero growth stock Po = Value of a constant growth stock, where gi D Po Do(1+g) I's Approximate YTM = [1+ (FV-MV)]/(FV+MV)/2 Approximate YTC = [I+ (CP-MV)c)(CP+MV)/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts