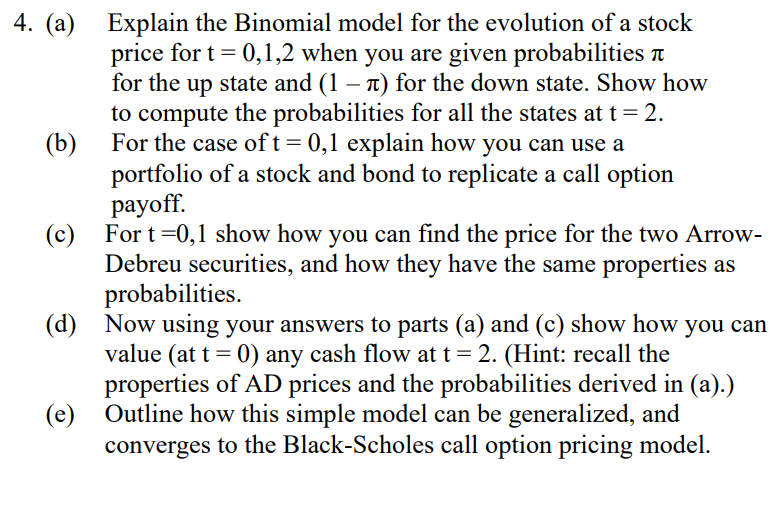

Question: = 4. (a) Explain the Binomial model for the evolution of a stock price for t= 0,1,2 when you are given probabilities i for the

= 4. (a) Explain the Binomial model for the evolution of a stock price for t= 0,1,2 when you are given probabilities i for the up state and (1 a) for the down state. Show how to compute the probabilities for all the states at t = 2. (b) For the case of t= 0,1 explain how you can use a portfolio of a stock and bond to replicate a call option payoff. (c) For t=0,1 show how you can find the price for the two Arrow- Debreu securities, and how they have the same properties as probabilities. (d) Now using your answers to parts (a) and (c) show how you can value (at t = 0) any cash flow at t = 2. (Hint: recall the properties of AD prices and the probabilities derived in (a).) (e) Outline how this simple model can be generalized, and converges to the Black-Scholes call option pricing model. = = 4. (a) Explain the Binomial model for the evolution of a stock price for t= 0,1,2 when you are given probabilities i for the up state and (1 a) for the down state. Show how to compute the probabilities for all the states at t = 2. (b) For the case of t= 0,1 explain how you can use a portfolio of a stock and bond to replicate a call option payoff. (c) For t=0,1 show how you can find the price for the two Arrow- Debreu securities, and how they have the same properties as probabilities. (d) Now using your answers to parts (a) and (c) show how you can value (at t = 0) any cash flow at t = 2. (Hint: recall the properties of AD prices and the probabilities derived in (a).) (e) Outline how this simple model can be generalized, and converges to the Black-Scholes call option pricing model. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts