Question: 4. (a) Explain the difference between Insurances payable at the moment of death and those payable at the end of year of death, using the

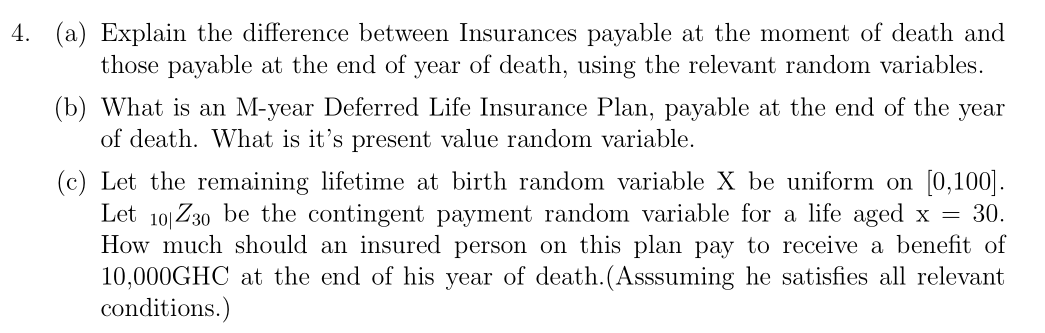

4. (a) Explain the difference between Insurances payable at the moment of death and those payable at the end of year of death, using the relevant random variables. (b) What is an M-year Deferred Life Insurance Plan, payable at the end of the year of death. What is it's present value random variable. (c) Let the remaining lifetime at birth random variable X be uniform on (0,100]. Let 10/230 be the contingent payment random variable for a life aged x = 30. How much should an insured person on this plan pay to receive a benefit of 10,000GHC at the end of his year of death.(Asssuming he satisfies all relevant conditions.) 4. (a) Explain the difference between Insurances payable at the moment of death and those payable at the end of year of death, using the relevant random variables. (b) What is an M-year Deferred Life Insurance Plan, payable at the end of the year of death. What is it's present value random variable. (c) Let the remaining lifetime at birth random variable X be uniform on (0,100]. Let 10/230 be the contingent payment random variable for a life aged x = 30. How much should an insured person on this plan pay to receive a benefit of 10,000GHC at the end of his year of death.(Asssuming he satisfies all relevant conditions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts