Question: 4. (a). On November 3rd, FED announced that it will purchase $600 billion of US Treasury bonds with maturities ranging from 2 years to 30

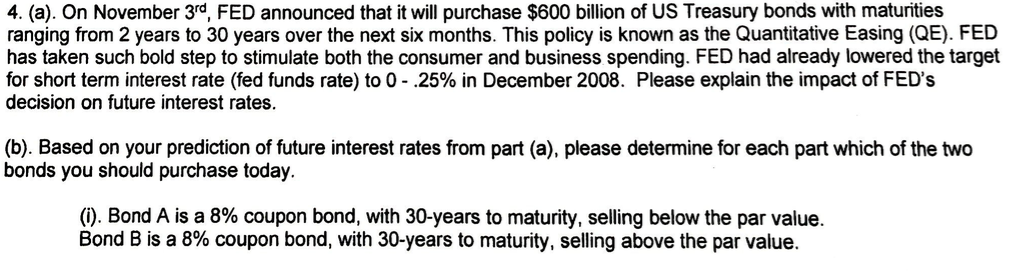

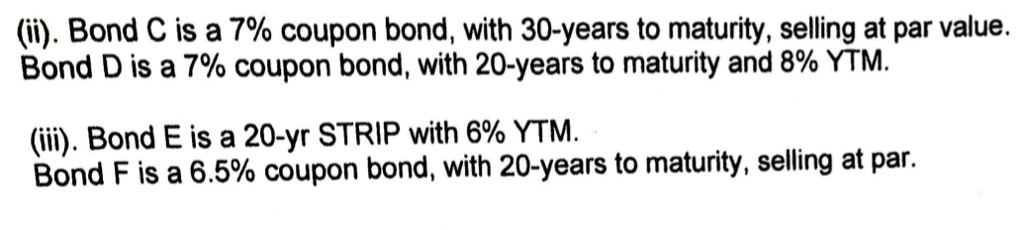

4. (a). On November 3rd, FED announced that it will purchase $600 billion of US Treasury bonds with maturities ranging from 2 years to 30 years over the next six months. This policy is known as the Quantitative Easing (QE). FED has taken such bold step to stimulate both the consumer and business spending. FED had already lowered the target for short term interest rate (fed funds rate) to 0-.25% in December 2008. Please explain the impact of FED's decision on future interest rates. (b). Based on your prediction of future interest rates from part (a), please determine for each part which of the two bonds you should purchase toda (i). Bond A is a 8% coupon bond, with 30-years to maturity, selling below the par value. Bond B is a 8% coupon bond, with 30-years to maturity, selling above the par value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts