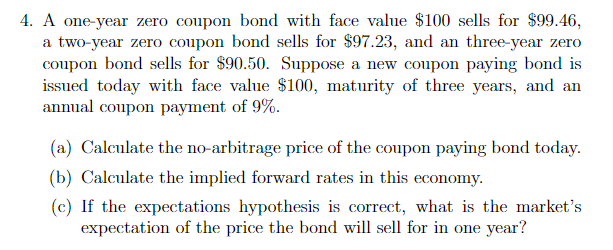

Question: 4. A one-year zero coupon bond with face value $100 sells for $99.46, a two-year zero coupon bond sells for $97.23, and an three-year zero

4. A one-year zero coupon bond with face value $100 sells for $99.46, a two-year zero coupon bond sells for $97.23, and an three-year zero coupon bond sells for $90.50. Suppose a new coupon paying bond is issued today with face value $100, maturity of three years, and an annual coupon payment of 9%. (a) Calculate the no-arbitrage price of the coupon paying bond today. (b) Calculate the implied forward rates in this economy. (c) If the expectations hypothesis is correct, what is the market's expectation of the price the bond will sell for in one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts