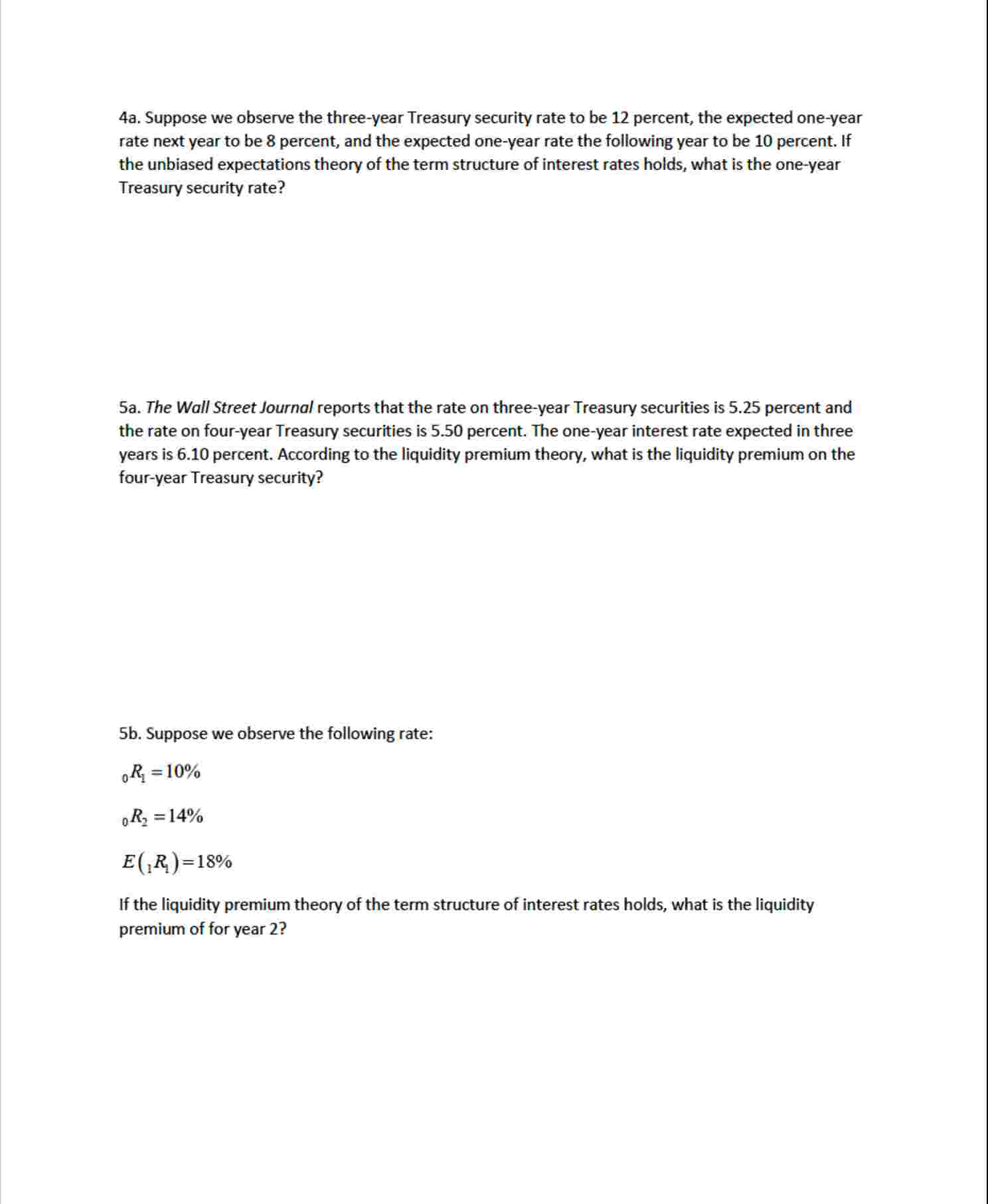

Question: 4 a . Suppose we observe the three - year Treasury security rate to be 1 2 percent, the expected one - year rate next

a Suppose we observe the threeyear Treasury security rate to be percent, the expected oneyear rate next year to be percent, and the expected oneyear rate the following year to be percent. If the unbiased expectations theory of the term structure of interest rates holds, what is the oneyear Treasury security rate? a The Wall Street Journal reports that the rate on threeyear Treasury securities is percent and the rate on fouryear Treasury securities is percent. The oneyear interest rate expected in three years is percent. According to the liquidity premium theory, what is the liquidity premium on the fouryear Treasury security? b Suppose we observe the following rate: beginarrayl R R Eleft Rrightendarray If the liquidity premium theory of the term structure of interest rates holds, what is the liquidity premium of for year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock